Insight

Ireland Economy Latest – H1 2022

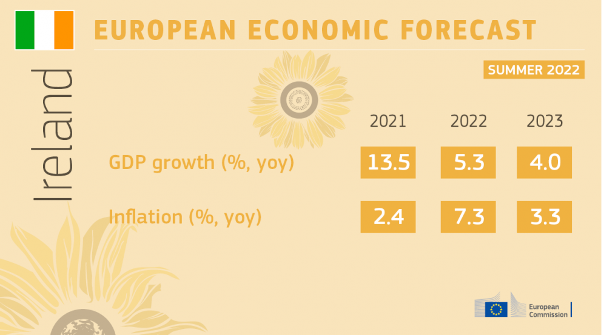

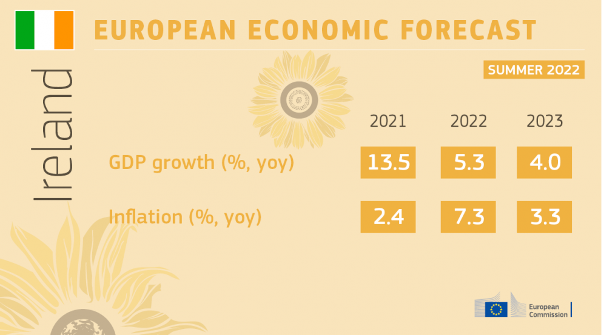

The outlook for the Irish economy is strong following its performance in the first half of 2022. Despite inflation rises which may persist and have put pressure on GDP growth, the economic recovery from the most acute effects of the Covid-19 pandemic has been robust. The European Commission revised its expectation for Ireland’s real GDP growth for 2022 down only slightly to 5.3% (from 5.4% in its May 2022 forecast), while the 2023 annual growth projection has been revised down to 4.0% (from 4.4% in May).

Image source from European Commission

Despite global economic uncertainty over the last couple of year, the Irish economy has been resilient. According to Eurostat, Ireland recorded the second highest level of GDP per capita in the EU in 2021, one place behind Luxembourg. In the nominal ranking, Ireland overtook Singapore to become the 2nd richest economy in the world, while in the Purchasing Power Parity (PPP) ranking, Ireland overtook Singapore and Qatar to become the 2nd richest economy in the world.

International trade and FDI are the key drivers of global value chains (GVCs) and they are both key contributors to Ireland’s economy. Ireland’s stock of inward FDI is one of the largest in Europe and its exports of goods and services as a percentage of GDP was 135% in 2021, according to the World Bank.

Below, we take a closer look at these two key economic drivers that contribute to making Ireland the third most competitive country in the eurozone and 11th in the world rankings.

Ability to attract investment and increase employment

Apple’s first facility outside of the US, located in Cork, Ireland (Image courtesy of Apple.com Newsroom)

Approvals of new investments and job creation by foreign multinationals in Ireland reached record levels in the first half of the year.

The Industrial Development Agency’s (IDA) mid-year results show that between January and the end of June this year 155 additional investments were pledged, up 9% on the same period last year and 10% above that recorded pre-pandemic in 2019. Of these, 73 were from new name companies setting up operations in Ireland for the first time and a similar number were located in regional parts of the country. The largest investments announced in the first half of the year included €12 billion from Intel, a new campus building at Apple in Cork capable of accommodating 1,300 staff, and 1,000 new jobs at TikTok and Workday.

“These are very strong half-year results achieved against a backdrop of a global pandemic, Brexit, considerable geopolitical uncertainty globally, inflationary pressures, supply chain challenges, climate change and energy issues, and, since the start of the year, Russia’s invasion of Ukraine,” said IDA chief executive Martin Shanahan, who is to step down in the coming months. He added, “We should never forget that the jobs and revenue created by multinationals helped to keep us out of recession when the pandemic hit and are now giving us the financial firepower to ease the cost of living crisis and avoid recession once again.”

Some of the leading investments secured

With regard to employment, Irish enterprises and businesses are active, particularly multinational organisations, given the significant amount of FDI. Workday’s recent announcement of the creation of an additional 1,000 jobs at their European headquarters in Dublin, which already has more than 1,700 employees, is one of many testaments to the long-term commitments multinationals continue to make in Ireland.

Job growth and a strong economy boosted the fundamentals for commercial real estate. The year-to-date rate of rental growth in the Dublin office market has surpassed expectations with prime headline rents for new high-specification ESG-compliant buildings in the city centre now circa €646 per square metre or €60 per sqft, according to CBRE’s May research report. In addition to recruitment activities in the Dublin market, there have been several significant regional job announcements in recent months, which in turn is feeding directly into the appetite for modern office buildings in cities including Cork, Limerick and Galway.

Export

With respect to international trade, according to the latest figures released from the Central Statistics Office (CSO) in May 2022, Ireland’s unadjusted exports of goods were valued at €18 billion. The increases in goods exports were driven mainly by growth in the exports of medical devices and pharmaceutical products. Exports of these goods accounted for 38% of all exports in 2021.

- Ireland is the 2nd largest exporter of pharmaceutical goods and medicines in the EU

- The level of employment in high tech manufacturing as a share of total employment is 29%, the highest in the EU

In terms of geographic breakdown of Irish exports, the EU accounted for 35% of total goods exports in May 2022 of which Germany was the largest importer, while the Netherlands and Belgium were second and third respectively. Total EU exports in May 2022 increased by €841 million (+15%) compared with May 2021. The USA was the main non-EU exports destination accounting for €5,416 million (30%) of total exports in May 2022.

Electrical and electronic equipment, optical and medical apparatus, and pharmaceutical products are the goods largely imported from Ireland to other parts of the world, including China and Hong Kong, Vietnam and the UAE.

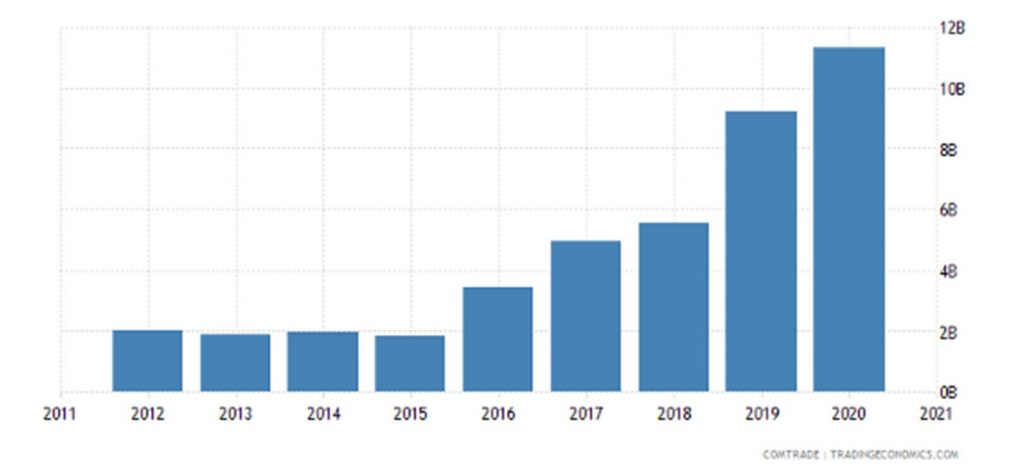

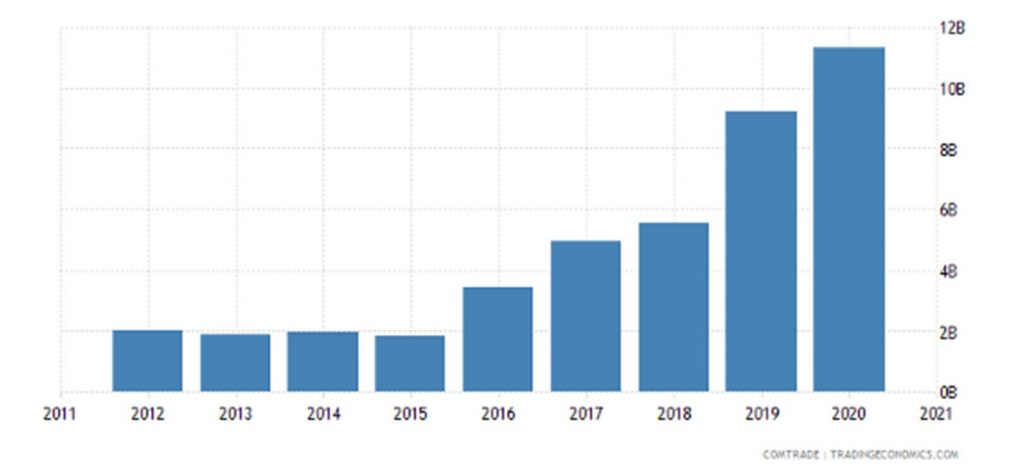

The table shows the value of goods in USD exported from Ireland to China.

According to the latest available data, in 2020 Ireland exported a total of $11.9 billion worth of goods to China, up about 18% from 2019. During the last 25 years, the exports of Ireland to China had increased at an annualised rate of 22.9%, from $67.9 million in 1995 to $11.9 billion in 2020.

The main products that Ireland exported to China include integrated circuits ($6.91B), nitrogen heterocyclic compounds ($867M), and pharmaceutical products (i.e. vaccines, blood, antisera, toxins and cultures) ($567M).

Food is also increasinly imported from Ireland to China. Exports of Irish pork to China hit a record high in 2021 – 40% of the total 542 million euros (US$604.6 million) of pig meat were exported to China, an increase of 8% from 2020. Ireland is now seeking to diversify its exports of meat to the country, said Conor O’Sullivan, Shanghai-based Manager of Bord Bia, Irish Food Board, the promotional agency for food products of the Irish government. “I have noticed that food consumption here is becoming more diverse. Chinese used to eat pork mainly, but more and more people are now trying imported lamb, beef, chicken and also plant-based protein,” he said. “This is a very big opportunity for high-quality Irish foods.”

Exports of Ireland to Hong Kong had increased at an annualised rate of 6.15%, from $177 million in 1995 to $787 million in 2020. The top three products that Ireland exported to Hong Kong were jewellery ($128M), packaged medicaments ($107M), and blank audio media ($96.8M).

Ireland also exported services to Hong Kong, including financial services ($125M), and insurance services ($68.3M) along with all other business services worth a total value of $345 million in 2018.

In 2020, Vietnam imported $1.76 billion worth of goods from Ireland. The main products were integrated circuits ($1.54B), packaged medicaments ($43.3M), and pharmaceutical products ($27.4M). Exports from Ireland to Vietnam had increased at an annualised rate of 24.6%, from $7.18M in 1995 to $1.76B in 2020.

Economic and population growth have been driving structural change in Vietnam’s economy. The population of Vietnam is set to rise to 100 million people by 2024, equivalent to around one-fifth of the current EU population and 20 times the current Irish population, and the rate of urbanisation will reach 40% by 2024. Vietnam’s growing urban population and increasing disposable income have contributed to the healthy growth of consumer food service, which has led to an increase in Ireland’s food exports to Vietnam. While meat and dairy products are the largest shares of this, beverages and seafood also contributed strongly.

The EU’s Free Trade Agreement with Vietnam presents a huge opportunity, especially with the elimination of 99% tariffs and non-tariff barriers. This makes it much easier for Irish exporters of dairy and livestock food products, such as skimmed milk, cheese and meats like pork and beef. Former Minister for Agriculture, Food and the Marine, Michael Creed said, “Ireland can bring particular assistance to Vietnam on the development of sustainable agriculture, but also that we can be an important source of high-quality food products for its growing population.”

In the UAE, which is home to an estimated 10,000 Irish expatriates and with a population of 9.6 million, Irish exports to the UAE rose 12%, and were close to $660 million in 2020 despite the challenges posed by the Covid-19 pandemic. The main products were packaged medicaments ($121M), gas turbines ($106M), and pharmaceutical products ($96.4M). Exports from Ireland to the UAE had increased at an annualized rate of 8.56%, from $84.6M in 1995 to $660M in 2020.

Summary

Against the backdrop of high COVID-19 vaccination rates, the full reopening of the economy in H1 is boosting a broad-based recovery. Business conditions underpin sizeable employment gains, while household excess savings and wage increases support consumer spending. The contributions of Foreign Direct Investment (FDI) and international trade to the Irish economy have been strong and are forecast to remain robust for the rest of the year with Ireland outperforming many EU countries, and making it an attractive and competitive country for businesses and investments.