Insight

IIP Updates and Current Available Options

The Irish Immigrant Investor Programme (IIP) offers HNW investors and their families a safe, simple, and proven route to permanent residency in Ireland – one of Europe’s safest and most stable countries. The Programme has a wealth of advantages, such as investment only required to be made after approval and minimal residing requirement. Family members of the successful applicants can also be benefited from the IIP:

- They have the right to live and work in Ireland, without any time constraints.

- They can get access to educational and healthcare benefits.

- They can apply for citizenship through naturalisation to obtain one of the most valuable passports worldwide.

- Visa-free or Visa on arrival to 189 countries, including the United States, Schengen Area, and the United Kingdom.

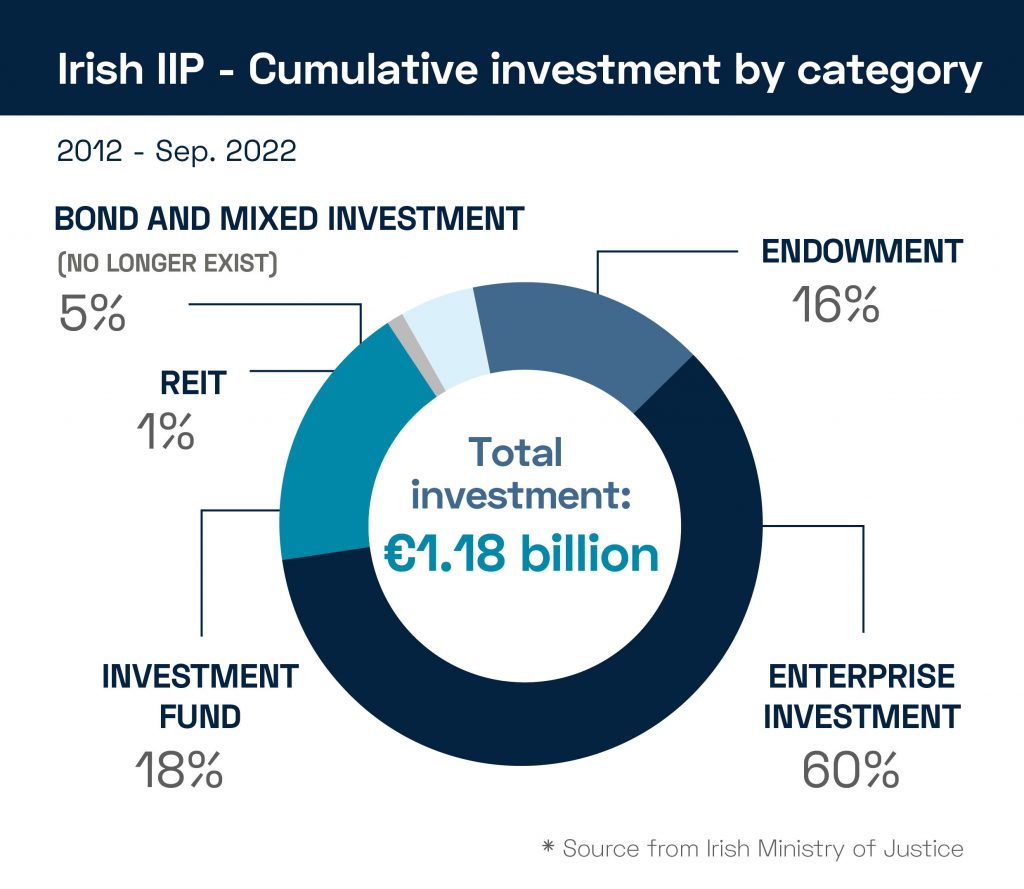

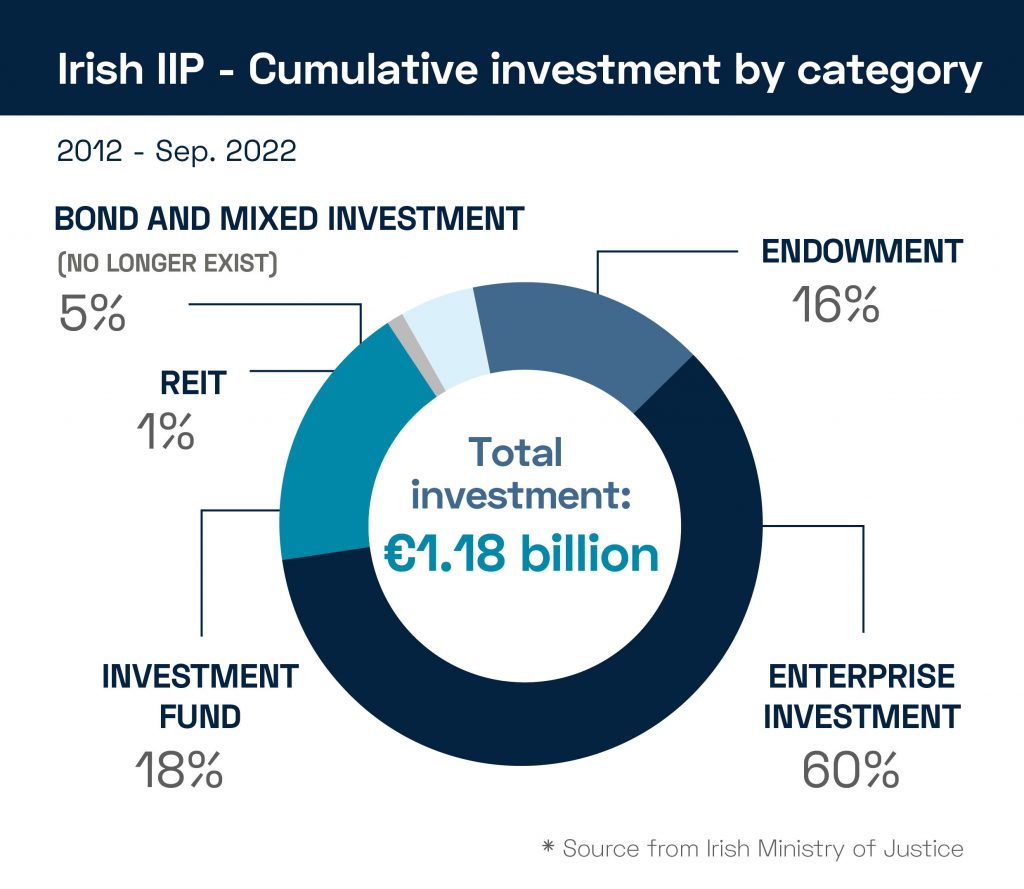

In return, the Programme helps to bring foreign investment into Ireland (more than €1 billion in total) to build or improve its infrastructure, create new companies or jobs and raise capital to boost the economy. It has also contributed to many local communities, hospitals and sporting organisations.

However, the government decided to close the Programme with immediate effect in February, with a few limited exceptions:

- The existing approved projects will not be affected for IIP applications and need to be completed within the timeframe set out per the business plan.

- Applications not yet submitted, but where the project was significantly developed with the assistance of the IIP Unit of the Department of Justice, may be granted a grace period of three months to submit the finalised application.

The closure has changed the Irish IIP landscape since then.

Current IIP availability

Since the sudden closure announced in February for this decade-old, sought-after Residency by investment programme, investors have been looking for available project options to grasp the final IIP opportunities during a grace period granted by the government.

Among the four IIP investment options – Enterprise Investment, Endowment, Investment Fund, and REIT, statistically and historically, the applications and investments largely go to Enterprise investments, followed by Investment Fund and Endowment.

Over the last few months, it is believed that the approved Enterprise Investment projects i.e. social housing schemes and nursing homes, and Endowment projects should have been all snapped up by investors, leaving only a handful of investment slots from investors who have withdrawn from the applications or investments after getting approvals. For any existing Enterprise Investment and Endowment projects that are still available on the market, IIP investors are advised to carry out their own full due diligence before investing to assure that their chosen projects have been approved in order to secure their future approvals.

Worth noting is that an extension has been granted to the Investment Fund option offering IIP to run until the end of 2023. Regulated by the Central Bank of Ireland, this low-risk investment fund route has been granted special permission to continue processing applicants for IIP until 31st December this year.

Characteristics of IIP investment Fund

- All funds have to be invested in Ireland and must represent equity stakes in Irish-registered companies that are not listed on any stock exchange.

- The funds and fund managers will have to be regulated by the Central Bank to conduct business in Ireland.

- Only fund managers with an established record of managing regulated funds will be accepted to manage funds in Ireland.

- Under this scheme, investors will receive a residence permit for 5 years. An initial permit for two years and another 3-year permit if investors keep the investment. After the 5-year period, investors can apply for renewals in 5-year tranches.

How can investors choose their IIP Investment Fund?

Each fund has their investment objectives and strategies, when choosing a fund for the purpose of IIP, broadly speaking, investors are suggested to consider the following 4 key areas:

- Understand the nature of the fund and its investment objectives: What companies and assets is the fund investing in and what is it trying to achieve, i.e. some funds invest in Irish enterprises and assets for achieving capital growth, while some simply provide loans to commercial sectors for earning interest.

- Understand the risk factors: Different investment strategies have their associated risks. Generally speaking, higher growth rates indicate higher risk. Also, the sectors where the investments go in would affect the performance of the fund, market performance is one of the key factors. The more diversified the sectors of the investments in the portfolio, the lower the risk of major losses that can result from over-emphasizing a single asset class.

- Know the fund managers and Board of Directors: The performance of the fund is largely dependent on the fund management team’s experience and expertise. Having a good understanding of the companies and key stakeholders in the fund is essential for investors to choose a suitable IIP investment fund.

- Understand the return and fees: if capital refund is the expectation, investors would have to choose a fund whose investment objective is aligned with the investors, as some growth funds do not provide the full capital return. Investors are also advised to understand the fund fee structure, as some funds would charge management fees and costs for operations.

It is worth mentioning that, although most of the funds are 5-year investment period, due to the funds’ nature of their maturity date, investors who invest in a fund may have less than a 5 year investment horizon due to each fund’s maturity time as well as IIP’s approval time.

Invest IIP with Bartra Wealth Advisors

Half a year since the closure announcement was made, in August, Bartra received over 20 approval letters for our clients across our offices. To date, Bartra have more than 300 approved Investors through IIP, with a total investment amount exceeding €220 million. The approvals prove that clients’ investment through Bartra is safe and we are reliable to deliver high-quality, government-backed projects to secure clients’ residency.

In addition to its minimal residency requirement, IIP offers some investment options that are capital protected investments and they are also passive investments, which means the initial capital of investors will be repaid to investors at its maturity and investors do not have to manage or operate their investments. This is another major advantage of IIP for those who are looking for a safe and secure investment opportunity. It is also hassle-free at the same time as it requires minimal time and effort.

Investing with Bartra not only can secure your path to a successful Irish residency, through Bartra’s one-stop-shop investment services and its five-year customer servicing and settlement services in Ireland, clients can be rest assured of a smooth transition and relocation in Ireland.

Click here to learn more about the IIP or to contact us.

Bartra only have a small number of available slots remaining for IIP-approved investment projects, contact us now and secure your successful IIP journey right away.

-拷贝-347x283.jpg)