Insight

Invest in high-income Irish property

Many of our clients may know, renting or buying a property in Ireland is extremely difficult due to its severe supply constraints. Because of the supply-demand imbalance, coupled with other factors such as its fast-growing economy and world-class education, more people are moving to Ireland than ever before, investing in real estate in Ireland can be uneasy, but highly profitable.

While there are no restrictions on nationality when purchasing property in Ireland, the property is low priced comparatively with developed English-speaking countries such as the UK and the US, but rents are relatively high, many buy-to-let investors have been finding the highest rental yields in Ireland amongst European countries in recent years, benefiting from the capital growth at the same time.

We previously provided a guide to buying a property in Ireland, in this article, we are going to discuss what makes Dublin’s buy-to-let property scheme attractive.

The two main sources of income in a buy-to-let investment are rental yield and capital growth. These are very different terms that describe the two income streams a property can deliver. It is also important for investors to understand the price-to-rent ratio which provides insight into a given property’s potential return on investment.

Rental yield and rental price performance

One of the most important metrics for an investor to consider is the rental yield they can receive. Rental yield is based on you letting your property out to a tenant and what you can expect the rental income over a year. Understanding the average rental yields in a property market is vital for making an informed decision for choosing a property for investment.

Irish properties provide higher average rental yields than many popular property investment global cities.

-1024x358.jpg)

-1024x358.jpg)

Although it is one of the best countries to invest in rental property, Ireland is not usually found on the list of the best countries for real estate investment due to a reason – availability of stock. Stock of residential property has always been a problem in Ireland and the problem continues to worsen. The number of houses for sale dropped 26% in three years up to September 2022. Furthermore, many new developments are snapped up by institutional investors, further reducing the availability of stock for individual investors to enter the market.

In terms of rental prices performance, according to the property website daft.ie, Irish rental prices rose the most on record in 2022 with increases of 20% in some cities. In Q4, average rents were 13.7% higher than the same period in 2021.

Which is best to buy for investment: 1-bedroom, 2-bedroom or 3-bedroom apartment?

When it comes to an investment property, bigger is not always better. Firstly, 1-bed and 2-bed appeal to the widest rental market compared to 3-bed properties, which means they are in higher demand and would minimise rent lost due to shorter vacant periods. Secondly, 1-bed and 2-bed typically provide stronger yields as the 3-bed property requires a higher capital entry point. Last but not least, in the exit strategy for an investment property, 1-bed and 2-bed have a stronger secondary market as they appeal to more owner-occupiers and have lower furnishing costs than a 3-bed property.

There are many advantages of investing in a 1-bed apartment for investors to invest in the Irish property market for the first time:

- It has a lower capital entry point compared to a 2-bed apartment.

- It is cheaper and easier to furnish than a 2-bed property.

- It has a lower maintenance cost.

- It appeals to young professionals and graduates, as well as young couples.

Buying 1-bed apartments is a good investment choice within the buy-to-let sector in the greater Dublin area. This is largely down to their appeal to a wide rental demographic, and because remote working is becoming a new norm for many companies in Dublin, many people would rather stay away from the city centre but in a less busy, more relaxing environment to live.

In Dublin some popular districts, gross rental yields range from 6.19% to 7.96%, which are generally considered excellent yields. One-bedroom apartments will earn relatively more than two-bedroom apartments. To earn higher returns, buy smaller units.

Capital Growth

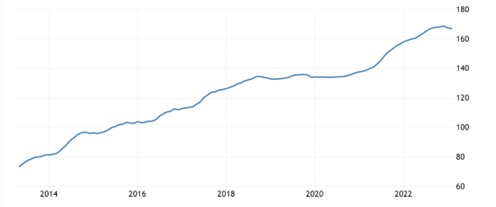

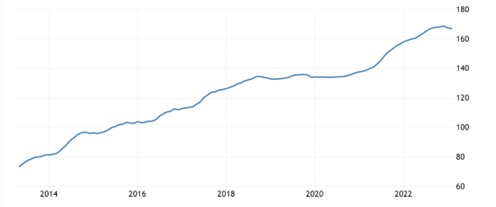

Another important source of income in a buy-to-let investment is capital growth. Capital growth is your profit earned on a property purchase and is based on the capital rises that you may experience as property prices go up.

According to Irish Central Statistics Office (CSO), in July 2022, the national residential property price index rose strongly by 13.1% from a year earlier, up from a y-o-y increase of 8.48% in the same period in 2021. The latest data from the Property Price Register (PPR) revealed that Irish house prices were up 8.9% in the first three months of 2023.

The graph shows the 10-year residential property price index in Ireland. Source from Central Statistics Office.

According to PPR’s same set of data, Dublin remained the most expensive county with the median price of homes sold in the first quarter of 2023 up 8.1% year-on-year and 1.2% quarter-one-quarter.

Investment properties in Dublin and the surrounding areas are anticipated to be benefited from a price increase. When considering the best places to buy in Dublin, you may want to consider the up-and-coming areas around the city, which provide amenities for families and commuters looking for the perfect balance between city life and quiet neighbourhoods. While your rental income may be less than the one of a property in the city centre, you will likely pay a lower purchase price. This means your overall yield and profit are healthier than if you opted for a smaller property in Dublin’s most elite districts.

Dublin property vs London property

Many people like to invest property in the UK, but many of them do not know Ireland can offer better value. We can compare the properties of the two places from their price per square metre (psm), rent per month, and price-to-rent ratio.

-1024x204.jpg)

-1024x204.jpg)

Investors can enjoy a 1.5 times larger space purchasing an Irish property than in the UK, for the same capital amount and a similar growth rate of property price.

-1024x204.jpg)

-1024x204.jpg)

-1024x204.jpg)

-1024x204.jpg)

From a rental perspective, although rents in some city centre locations are higher in London than in Dublin, the property price is lower in Dublin, offering stronger rental yields (data refer to the table above). investors would also have to take the carrying costs into account, those are the fees for owning a property, for example, the property management fees, and usually the fees are lower in Dublin than in London.

-1024x204.jpg)

-1024x204.jpg)

Investors are suggested to consider the price-to-rent ratio when investing in a property. The ratio is an essential indicator because it provides insight into a given property’s potential return on investment (ROI). Generally speaking, a lower ratio indicates that the property has good potential to generate long-term returns, while a higher ratio suggests that the property may not provide adequate returns over teams, and is less likely an investor can achieve positive cash flow from renting the property out after deducting from operating expenses and mortgages. A good price-to-rent ratio is considered to be 15 or lower indicating that investing in real estate in that area would be more profitable for renting.

The expected rental income of this Malahide project is around €2,250 for a 1-bed unit and €2,700 for a 2-bed unit, offering gross rental yields of about 5.6%-6.5%.

Conclusion

Properties provide an excellent hedge against inflation that attracts many investors who are currently expanding their property portfolio. Ireland ranks highly as a strategic location for investors seeking to secure long-term income generated by property investments. Dublin and its surrounding areas offer a stable housing market with the potential to generate high rental income as well as to make great ROIs on the right properties, making it an excellent location for global property investors.

230516_1-575x1024.jpg)