Thoroughly evaluating the risk profile of an immigration investor programme or investor residence scheme can seem daunting, as every programme and scheme has immigration and financial risks. Once committed, risks can change through the various stages of the process. It is imperative that project owners and investors have candid conversations about risk. To help guide those conversations, we have put together a list of some of the most prevalent risk factors and an explanation of the asset types which are commonly seen under immigration investor programmes as the underlying assets.

Risk Factor 1: The Programmes

Immigration, and investment immigration in particular, can be a key driver of a country’s economic growth. The inflow of investments and population mobility help a country to gain talent, high-net-worth families and capital. Immigrant investor programmes or investor resident schemes usually have higher asset and investment requirements with greater flexibility around travel and physical presence when compared to other lower-tier immigration programmes or quota-based skilled professional immigrant programmes. Most of these programmes aim to support local infrastructure, boost certain financial or commercial sectors or enhance community living through job creation and recreation. However, not all the programmes and schemes create a positive result for the country. For example, over-investment in the residential market can create a housing bubble where locals cannot afford to buy property in a reasonable timeframe with their salary and income. Other schemes may lead to a range of other risks particularly around security, money laundering, corruption and tax evasion. Some programmes may change due to political influences.

Travel and settling requirements, and the right of residency status are aspects that investors need to pay attention to. Most English-speaking countries will require actual residency for a minimum of five years. With regard to residency status, investors are advised to pay attention to the visa or permit types, as some may be issued in the form of a Temporary Resident Visa without the right to access local benefits, and may require investors to pass a language test, a medical test or to apply within a certain age bracket to obtain permanent residence.

Additionally, it’s important if holding a dual residency to check the country’s residence rules and when the tax year starts and ends. Staying in a country for more than 183 days in a tax year, may make an investor liable for taxation if the country has a global tax law, meaning that the investor’s overseas income is taxable to the country.

Risk Factor 2: The Projects

Investing in a good project in a stable market is the best way to mitigate market risk. This involves evaluating the market conditions in a particular geographic area, including demand, competition and financials.

To scope out the market conditions, investors and their advisors should thoroughly review a project’s market study. Independent research is required to look for indicators that the market is stable, shows strong signs of growth, and that the project will benefit from various drivers that will continue to push demand for the project. For example, a hotel would benefit from being located near a university, an attraction or an international airport, since these all have a broad base of users frequently looking for hotels. The market study, in addition to the business plan, should also discuss the competition. Look for signs that the project has a reasonable plan regarding how it will compete. It is also advised that investors understand the operational financial information and assumptions in the project’s business plan. For example, if a market study determines a hotel in a location will have an expected occupancy rate of x and an average daily rate of y, make sure those are the same figures used by the project. If not, run a stress test on the financials to see how it performs at these determined market rates.

The investor should assess a developer to see if they are creditworthy. Look for developers and operators with a trusted and extended track record. This helps show they can manage their business both when times are good and also during downturns.

A wider market assessment should also take into account the current pandemic situation, where some sectors, such as hotels, hospitality services and student accommodation, have been severely affected in a way that may affect a project’s financial stability.

Risk Factor 3: Liquidity and Return of Principal

A looming concern for most investors is the return of their investment. Working with their advisor, investors should run financial models to see if a refinancing event or sale of the project would generate enough cash to pay back existing debt and investors. Assumptions in the project’s exit plan, such as the anticipated sale price or cap rate, should be cross-referenced with a market study or other available data to ensure it is reasonable.

Some projects are easy to exit, for example those where terms and repayment are specified in the Loan Agreement, while some may be affected by market performance when redeeming the investment such as funds or bonds. Some may have to sell the asset where, in the case of residential property for instance, the return of the capital would depend on the secondary market and market value. If it’s a business, it may depend on the valuation of the business entity, the tangible and intangible assets.

Understanding Asset Types and Their Values

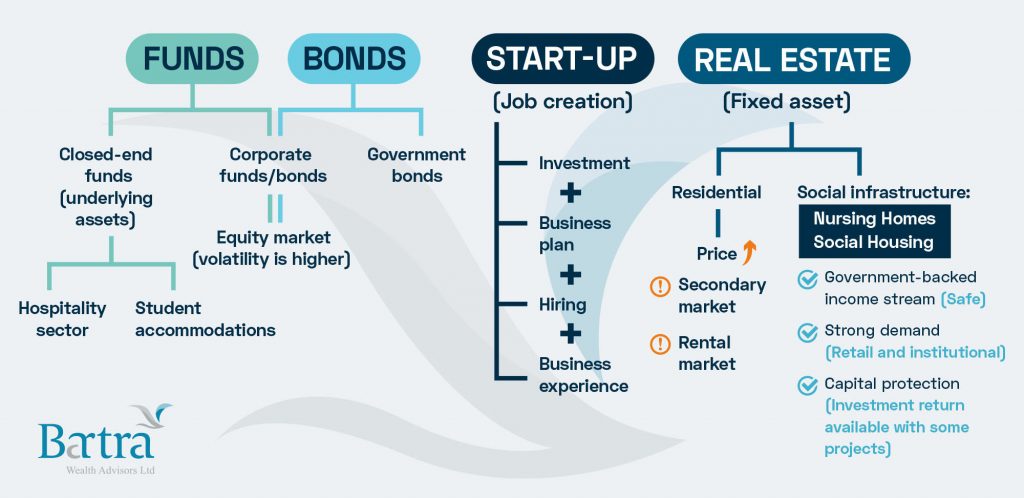

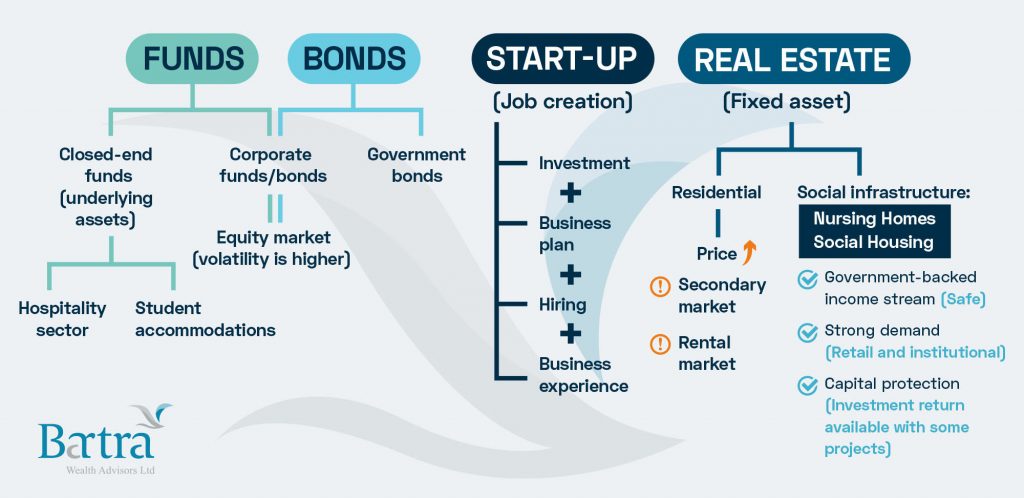

To assist you on your journey, these are some of the most common types of investments an investor may encounter when researching immigration investor programmes:

Funds

Closed-end funds are pooled money investments that have a primary focus. Investors need to understand how the fund is managed, whether the fund is approved and regulated by the local monetary and financial authority, what assets the fund invests in, and the fund’s performance either on asset value or profit. Repayment to investors would be dependent on the market condition and fund performance while management charges are also a consideration.

Bonds

Some investor visas can be obtained by investing in Government Bonds or Corporate Bonds. Government Bonds are considered low-risk investments since the government backs them. Corporate Bonds can be share capital and/or loan capital in active and trading registered companies. Since these are equity market-linked, the value can be affected by a company’s credit rating, price volatility is higher and the risk level is also relatively higher.

Start-up and Entrepreneur

Start-up and Entrepreneur visas have expanded rapidly since 2012 as many governments like to encourage foreign capital to run businesses in the country to support the economy and employment development. Some programmes require applicants to have experience in business planning, management and control of financial resources on top of the investment requirement. There are many factors to consider including hiring and domestic competition. Exiting a business is also not a straightforward process and the value of the business depends on its tangible and intangible assets, which will all affect the return of the invested capital.

Real Estate – Residential

The most common investor residence schemes and investor citizenship schemes in the EU are residential property investments where the amount of money required usually does not exceed €500,000.

Although the entry point of these “Golden Visa” schemes is lower than many immigrant investor programmes, a spike of people investing in the private residential market is causing housing pressure in local metropolitan areas, with some programmes putting an end to it, including Lisbon and Porto in Portugal. Also, when buying residential properties, some investors may have concerns around the secondary market where it may not be easy to resell or exit from their investments.

Real Estate – Social Infrastructure

There are many advantages to investing in social infrastructure projects. They are tangible fixed assets and the programmes are often supported by governments to help local communities and increase capital inflow. These assets can be government-backed, either with a long lease signed with the government or with subsidies from government funds. Furthermore, due to the nature of population growth and ageing populations, and as a result of the financial crisis in 2008 and the 2020 global pandemic, there is a shortage in social housing and nursing home supply, while demand for these assets is strong, something that is true globally and not only specific to Ireland.

To learn more, read Impact Investing – The potential of Social Housing and Nursing Homes in Ireland.

As one of the largest property developers in Ireland and with a proven track record, Bartra is here to help you understand the value of nursing homes and social housing projects in Ireland and to mitigate your immigration risk.

Nursing home and social housing investments are under the IIP Enterprise Investment option. Before committing to any IIP Enterprise Investment, below are some of the questions investors would have to ask:

- Who is the developer of the project and what is the scale of their portfolio?

- Do they have a successful project completion track record and experience in running these types of projects?

- Are these projects located in much-needed areas, such as Dublin?

- Are these properties new-build, second hand, converted or refurbished developments? Valuations vary across developments, with new-builds having the highest value.

- Do these projects qualify for immigrant investor programmes where the government’s initiative is to increase the supply of infrastructure?

- What is the connection between the selling company and the developer, and where is the company registered?

Due to the IIP’s flexibility and its investment safety, Ireland is increasingly becoming an immigration hotspot, and more immigration companies have entered the market. By understanding the risks and asset types, we hope that investors can choose suitable immigration programmes and will be able to work with project owners collaboratively to increase the overall likelihood of success. We are proud of our services, our projects and our 100% success rate of helping our clients to obtain residency.