When it comes to immigration, it’s important to consider the future of the country you are moving to and the opportunities it can offer you and your family. In a healthy ecosystem, new immigrants and their offspring can benefit from economic growth and social protection, while the nation can take advantage of the increased output and productivity that immigrants bring, both in the short- and medium-term.

Ireland’s future is bright in many respects, and it offers ample opportunities for immigrants and their children, particularly as it seeks to pivot to an Innovation Economy.

The Innovation Economy is an economic theory that has been gaining traction among business leaders and scholars in recent years and is based on the idea of entrepreneurship and that individuals, institutions and technological change drive economic growth.

Innovation is key to maintaining Ireland’s competitiveness in global markets. The world’s geopolitical, social, environmental, economic and technological challenges, and particularly the decision of the United Kingdom to leave the European Union, have forced Ireland to be more active in promoting its interests and finding new markets and opportunities to deepen and renew relationships and alliances, both in Europe and beyond.

A number of initiatives have been introduced by the Government to encourage Ireland to become an innovative and internationally competitive enterprise base for growing employment, sales and exports.

Global Ireland 2025

▲ Taoiseach launches Global Ireland: Ireland’s Global Footprint to 2025. Image source: merrionstreet.ie

Global Ireland 2025 is the Government’s ambitious strategy for doubling the scope and impact of Ireland’s global footprint. Its aims are manifold, seeking to diversify and grow Ireland’s exports and encourage inward investment and tourism, particularly in response to the challenges posed by the UK’s departure from the EU. There is also a desire to strengthen Ireland’s engagement with its 70 million-strong diaspora, to bring Irish culture to the wider world; and to support Ireland’s foreign policy objectives.

Building strong connectivity with important major cities around the globe is key. The Department of Transport, Tourism and Sport, alongside Tourism Ireland, are working closely with airports and airlines to actively pursue routes of strategic importance. While decisions on direct flights are largely driven by commercial considerations, Ireland is seeking to encourage direct links with a number of regions, thereby maximising the potential for increased tourism and trade from those locations. The first-ever direct commercial flights between the Asia-Pacific region and Ireland are now in operation, with scheduled flights from Dublin to Beijing and Hong Kong.

Under the Global Ireland 2025 Initiative, Ireland’s target is for 15% of its student population to be international students. Expanding the Government of Ireland Scholarship scheme; increasing in-country promotion of Ireland in new and emerging markets (such as Vietnam, Thailand, South Korea, Africa and South America); expanding the Academic Mobility Fund; and achieving greater impact in terms of international research collaborations and partnerships are some of the ways in which it hopes to achieve this goal.

One of the Global Ireland 2025 strategies worth highlighting is The Creative Ireland Programme, which was established in 2017. It aims to deliver a compelling proposition for Ireland, based on its culture and creativity, to enhance its international reputation and increase its influence in the world. The programme is built around key themes: Creative Youth, Creative Communities, Creative Places and Creative Nation.

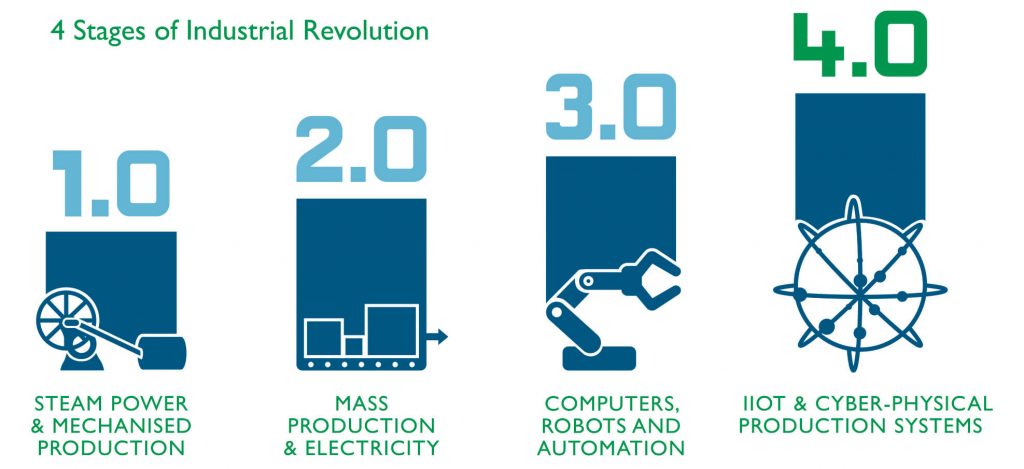

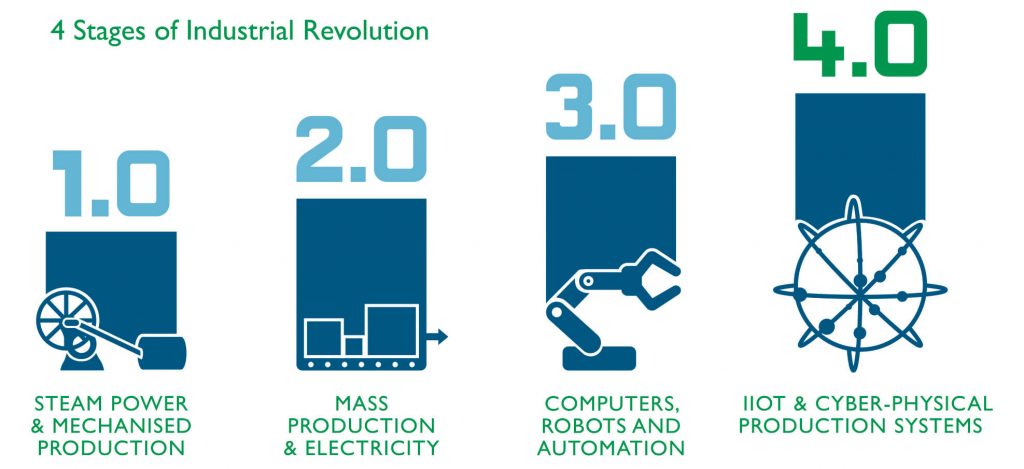

Ireland’s Industry 4.0 Strategy

▲ Image credit Codico Coding and Marketing Solutions

Through the Industry 4.0 Strategy, the Government is responding to the transformation resulting from the advance of digital technology with a plan to help ensure that by 2025 Ireland will be at the forefront of the fourth industrial revolution and Industry 4.0 adoption.

The term ‘Industry 4.0’ refers to the convergence of information communication technologies (ICT), which include cloud computing, Internet of Things (IoT), high-performing computing, machine learning, big data and analytics, robotics and digital fabrication, to enable the ubiquitous digital connection of machines, workpieces and IT systems.

From a macroeconomic perspective, Industry 4.0 offers the potential for significant economic growth, with estimates that digitalisation of manufacturing could add €110 billion per year to Europe’s industry base. For Ireland, it is estimated that there will be positive workforce growth in the manufacturing sector through the adoption of digital technologies between 2019 and 2023.

As process innovation built on digital technologies can lead to more efficient and flexible production processes with increased resource efficiency, Industry 4.0 adoption should also contribute to the climate action agenda set out in Ireland’s Climate Action Plan 2019, while also benefiting industries such as Pharmaceuticals and Chemicals, Food and Drinks, Computer and Electronics and Engineering.

Development Within Ireland

Steps are also being taken for internal improvement in Ireland, from the government to education sectors, with a number of initiatives to support social and economic growth:

Government

▲ Image credit Eolas Magazine

Project Ireland 2040 Project

This is the Government’s initiative to make Ireland a better country for all of its people. It is expected that by 2040, there will be an additional one million people living in Ireland (currently it has a population of around 5 million), which will put pressure on infrastructure and services: more people will be travelling to work, school and universities, more buildings will be required to accommodate them, clean water will be needed for homes, farms and industry, and more and better care facilities will be necessary for the elderly. Project Ireland 2040 therefore consists of a National Planning Framework, which sets out a spatial strategy to accommodate these demographic changes.

The initiative seeks to achieve ten strategic outcomes, one of which is to have a strong economy, supported by Enterprise, Innovation and Skills.

Ireland has been very successful in attracting major foreign investment, and generating high quality, large-scale employment. While aiming to retain its competitiveness in mobile international investment, it will now also give equal priority to its local enterprise economy. The focus will be on boosting regional growth potential, increasing research, development and innovation, and investing in higher education and further education and training. A new €500m Disruptive Technologies Innovation Fund will drive collaboration between the research, education and enterprise sectors.

Future Jobs Ireland

Future Jobs Ireland seeks to put the country’s economy in a better place to withstand shocks, as and when they appear. It involves a deliberate policy shift to increase quality jobs that allow for better living standards, but also sustainable jobs, which will be less vulnerable. The strategy will focus on five pillars: embracing innovation and technological change; improving SME productivity; enhancing skills and developing and attracting talent; increasing participation in the labour force; and transitioning to a low carbon economy.

Education and Universities

Education, government initiatives and economic development are all closely linked. The Irish Government sees education as strategically interlinked with national planning and has successfully developed programmes with schools and universities at all levels to establish Ireland as an international base for technology, science and financial services.

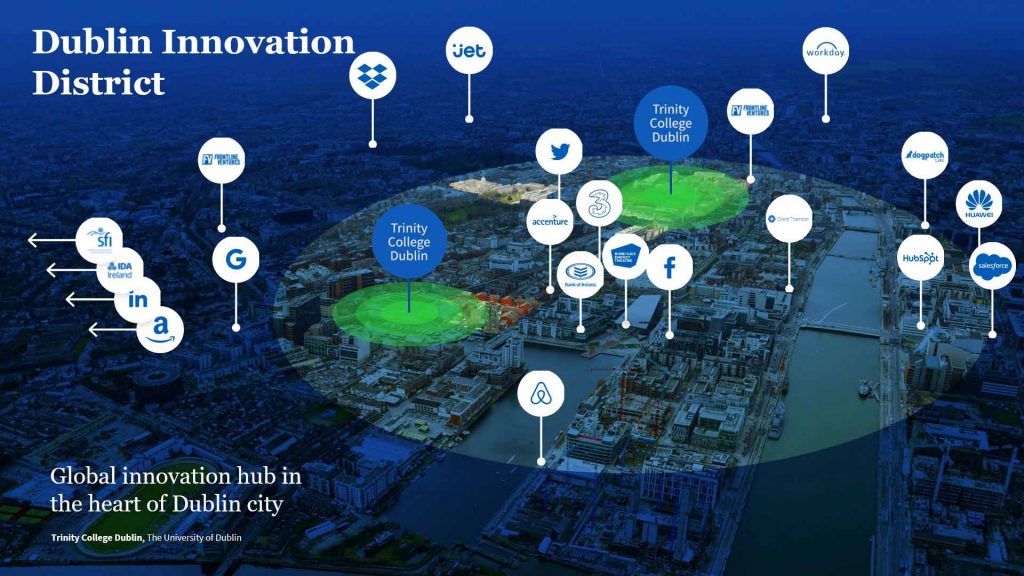

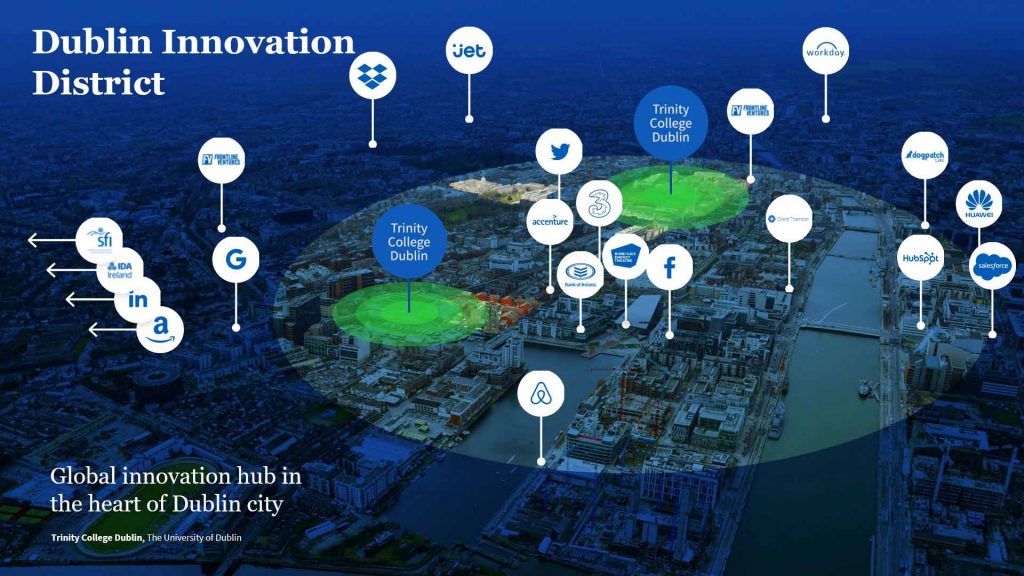

Trinity College Dublin – Trinity encourages an entrepreneurial spirit, providing incubation programmes for student-led companies, and has been named Europe’s leading university two years in a row for producing venture-backed entrepreneurs. Its programmes support early-stage start-ups and entrepreneurs by offering them the opportunity to participate in its accelerator programmes and providing funding, co-working space on campus, access to expert mentors, and a structured programme of workshops and fireside chats.

Dublin has an extraordinary cluster of technology and life science companies. Image credit Trinity College Dublin

Technological University Dublin and CeADAR – There is a major collaborative project across Europe to design a new Master’s programme in Artificial Intelligence that addresses human and ethical issues around the topic. The total cost is expected to be €3million and the project is to be delivered at universities in Ireland, The Netherlands, Italy and Hungary. Ireland is front and centre of the initiative thanks to Technological University Dublin and CeADAR, Ireland’s national centre for Applied Data Analytics & AI based at University College Dublin.

Company Movement

Ireland is becoming an international tech and innovation hub – Dublin ranks the third best European ‘tech city of the future’ – with companies from the US, UK and China, among many others, moving to Europe’s ‘Silicon Valley’, which serves as a gateway to the European market. MedTech, FinTech and DataTech are booming, which provides strong economic growth and increases Ireland’s appeal.

Following the use of Ireland as a data centre and operations hub by major technology companies including Amazon, Facebook and Alphabet Inc, TikTok, which is owned by China’s ByteDance, plans to open its first European data centre in Ireland with an investment of about €420 million euros. It will also open a new cybersecurity centre there as part of its efforts to “stay ahead of next-generation security threats”.

Additionally, 12 players in the Irish insurance sector joined forces to promote the country as an EU hub for the growing InsurTech industry, including AA Ireland, AXA, ALD Re, Allianz, Greenlight Re, Insurance Ireland, Irish Life, Laya Healthcare, New Ireland Assurance, Unum, SCOR and William Fry.

Other tech applications include Google and Dublin City Council’s “Air View Dublin” innovative partnership. This will see Google’s Street View car take to the streets of Dublin to measure air quality across the city.

Fun facts

- Ireland ranks number one worldwide for immunology

- Ireland ranks number one worldwide for animal and dairy science

- Ireland ranks number two worldwide for nanotechnology and agricultural science

- Ireland ranks number two worldwide for molecular biology and genetics

Summary

The future is bright for Ireland. A global tech hub in its own right, it continues to attract global talent, companies, entrepreneurs and investors, thereby providing employment and sustainable growth in the Irish economy.

Immigrating to Ireland is an optimal option for the next generation as a place for young talent to flourish. Contact us now to obtain Irish residency for you and your family.