2020 has been a challenging year. It has forced people to adapt to a new reality. But at Bartra, we remain optimistic. We have seen our teams thrive on change. And our ever-present desire and drive to share ideas, to collaborate, create and innovate, and to continue making progress, is undeniable. This year has not altered our fundamental belief that great investments require three things: great locations, great people, and the right opportunities. Bartra prides itself on consistently delivering all three for clients and investors and we are grateful that we have been able to help many of our clients achieve their goals, while also being recognised by the industry for our efforts.

As another year comes to a close and we look to the year ahead, we would like to share some of our achievements and to thank everyone – clients, business partners and our staff – for contributing to our strength and success.

Accomplishments:

- 2 IIP project completions (Northwood, Beaumont)

- Close to 100 IIP applications

- 4 awards

A little throwback to Bartra’s highlights from the last 12 months.

January

- The Irish Government’s Ireland Strategic Investment Fund (ISIF) invested €8 million in Bartra’s co-living business at the end of 2019.

- Received 20 IIP applications from Hong Kong investors since the Hong Kong office has opened in August 2019.

- First Hong Kong investor, who applied in August 2019, received approval from the Irish Naturalisation and Immigration Service (INIS).

“I am proud that the ISIF has invested in our business. This is testament to both the quality of Bartra’s projects and the expertise of the personnel putting those projects together. Our development projects support local housing requirements: co-living projects offer accommodation for young professionals; nursing homes provide critically needed care for the elderly and vulnerable; social housing caters to those on housing lists. As the investment immigration arm of Bartra Group, with offices in Hong Kong and multiple cities across Mainland China, Bartra Wealth Advisors has seen increased demand for investment in the social housing and healthcare sectors, with international investors keen to acquire these government-backed asset types. We offer investors direct access to our social housing and nursing home projects, which are good, safe investment opportunities that support the local community and are also IIP-qualifying for obtaining Irish residency.”

James Hartshorn, CEO and Co-founder of Bartra Wealth Advisors.

February

- Northwood Phase II, Bartra’s Nursing Home project, completed on time and within budget.

- The year’s first batch of Stamp 4 visas arrived on 14 February as a Valentine’s Day gift for our clients.

March / April

- In response to the pandemic, Bartra held its first webinar.

- Bartra received visa approvals for applicants from November 2019 on 22 and 23 April, with a 100% success rate.

- Henley Bartra, the joint venture with Henley, the global private equity real estate investor, sold Phoenix House to private Irish investors for €16 million.

May

- Declan Carlyle was appointed CEO of Bartra Healthcare.

- Bartra received renewal approvals for applicants from January and February, with a 100% success rate.

- Clients who invested in our Social Housing project phase II and received pre-approval in April were granted Stamp 4 visas.

June / July

- Construction began on our Social Housing project Poplar Row.

- Batra held a webinar in collaboration with IDA and Knight Frank.

- James Hartshorn, CEO and Co-founder, was interviewed by Investment Migration Insider (IMI).

- Clare Guinan, who works at our Loughshinny Residential Home, was featured in Irish Times.

August / September

- Loughshinny project scored 100 during an inspection for the Health Information and Quality Authority (HIQA) certification.

- Bartra participated in the International Migration Summit (IMS) Summit in Shanghai.

- The Poplar Row project signed a 25-year Enhanced Lease with the government.

October

- Bartra held its first press conference in Hong Kong, which saw more than 30 news platforms report on Bartra over two days.

- Jeffrey Ling, Hong Kong Regional Manager, was featured on Apple Daily’s news and video platforms, and hosted a webinar with a tax partner to discuss Ireland immigration.

- Bartra won Uglobal Immigration Magazine’s Top 25 Developers Award.

- Bartra received 50 applications from Hong Kong clients.

November

- Beaumont, our biggest nursing home project to date, completed construction ahead of schedule and entered HIQA inspection phase.

- Bartra participated in one of the world’s largest international migration summits in China, the 2020 Global Migration Summit of Entry-Exit Industry.

- Bartra won Supreme Brand of Overseas Investment & Immigration Consultant Firm Award 2020, organised by CAPITAL CEO X Entrepreneur.

- Bartra held webinars with law firm Oldham, Li & Nie and tax advisory firm Cooney Carey, and with Hong Kong’s South China Morning Post.

- Jeffrey Ling was interviewed by i-CABLE TV Financial News channel.

December

- Bartra Homes launched a new luxury residential project, Glensavage, Blackrock, comprised of 8 contemporary homes and 14 apartments.

- Bartra secured planning permission for our €25 million co-living scheme on Merrion Road.

- Bartra was named Innovator of the Year – Real Estate at the HKB Management Excellence Awards.

In the past year, Ireland has ranked among the best-performing economies in the western world, with GDP growth of 3.4% (ESRI). Looking ahead, export-driven growth of 5.3% in 2021 is forecast (Ibec).

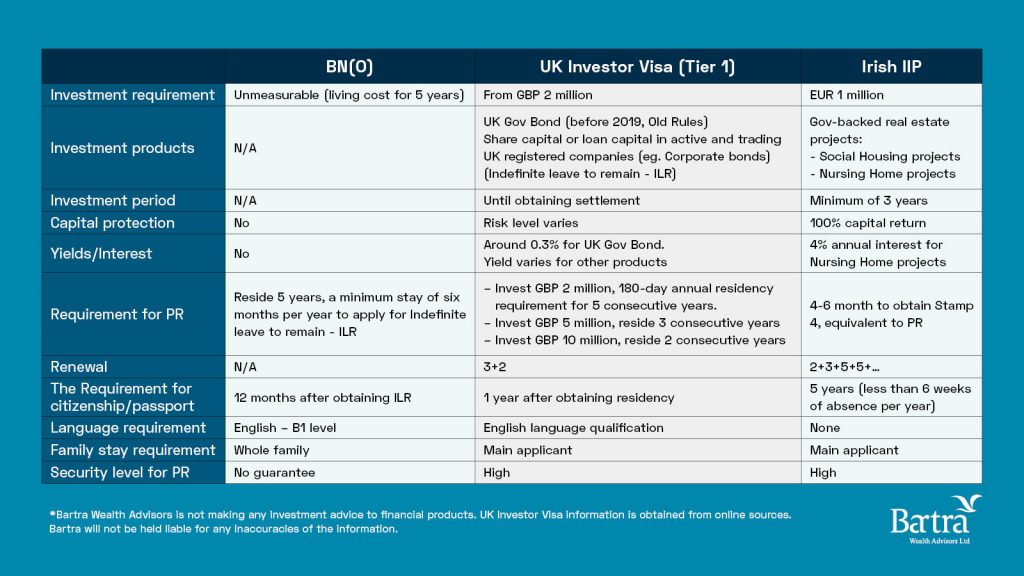

With regard to the IIP, we believe that interest in the programme will steadily increase as businesses and affluent individuals recognise the personal and professional advantages of maintaining a foothold in Europe. We foresee strong demand from China, Hong Kong, Vietnam, India and the UAE, as well as interest from South Africa, Canada and the UK.

As a company, we are excited to welcome 2021 and will continue to deliver our world-class services and products to investors and clients. In the spirit of the tagline of our Immigration Insight video series – Joy of Living – we’d like to take this opportunity to wish everyone a joyous, prosperous and healthy New Year!