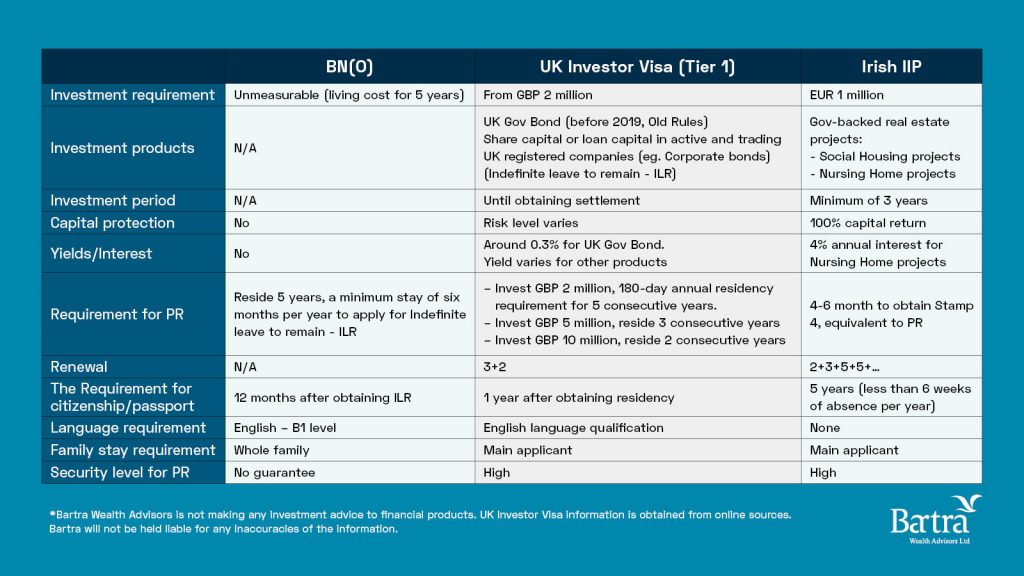

Hong Kong’s education and employment environments have become increasingly competitive, which may have contributed to the surge in interest in emigration. A growing number of parents are seeking alternatives to schools in Hong Kong, with more than 50% of parents expressing an interest in sending their children overseas for secondary and tertiary education, according to Prudential’s Hong Kong Parents Savings Gap Survey in 2019. Fast-track immigration has become an attractive option, as parents eagerly try to create a better future for their children. And interestingly, parents are shifting their interests from the UK to Ireland.

Bartra Wealth Advisors’ Hong Kong Regional Manager Jeffrey Ling said: “As a father of two kids, I know exactly how most Hong Kong parents feel. A high-quality learning environment and a good education system are the cornerstones that lead children to success. Ireland’s education system is among the best in the world and has been highly valued by the local government for many years. The primary goal of the Irish education system is to provide a broad spectrum of cultural, artistic, sporting, psychological and spiritual development as well as to prepare children for academia. Educational programmes at primary and secondary levels are designed to fulfill and develop a wide array of talents and to support childhood development mentally, artistically and physically. Compared to traditional education in Hong Kong, parents are increasingly willing to allow their children to receive an education in Ireland.”

It is worth noting that Irish graduates have a wealth of job opportunities; plenty of the world’s leading companies are located in Ireland with six top growing sectors that include IT services, accounting and auditing, innovation- and intellectual property-related enterprises, green sector jobs, business and financial services, and medical and pharmaceutical. There are also jobs in industries such as food and wine. Studies in medical care, social work, computing, engineering, accounting, animation and game design are in particular demand locally. In 2019, the Organisation for Economic Co-operation and Development (OECD) noted that Irish graduates are the most productive employees in the world among international companies. Employers, both national and international, affirm the quality of graduates from the Irish education system.

The Irish education

Hong Kong and Ireland have strong links in many areas, particularly education. Both are English speaking and have similar systems influenced by Britain. In fact, Hong Kong has more than 6,000 graduates from Irish Universities and the education sector in Hong Kong has long-established Irish links; tens of thousands of people in Hong Kong have studied in Catholic schools run by Irish priests. According to the Irish International Education Center (IIEC), an increasing number of Hong Kong parents are keen to send their children to study in Ireland. Established in 2012, the same year the Hong Kong DSE was implemented in Hong Kong, the IIEC is committed to and specialises in promoting Irish education. It has organised regular visits to Ireland and summer camps for students to experience the culture and study atmosphere in Ireland, and hosts regular seminars and information sessions for different stakeholders including students, parents, teachers, careers staff and school principals.

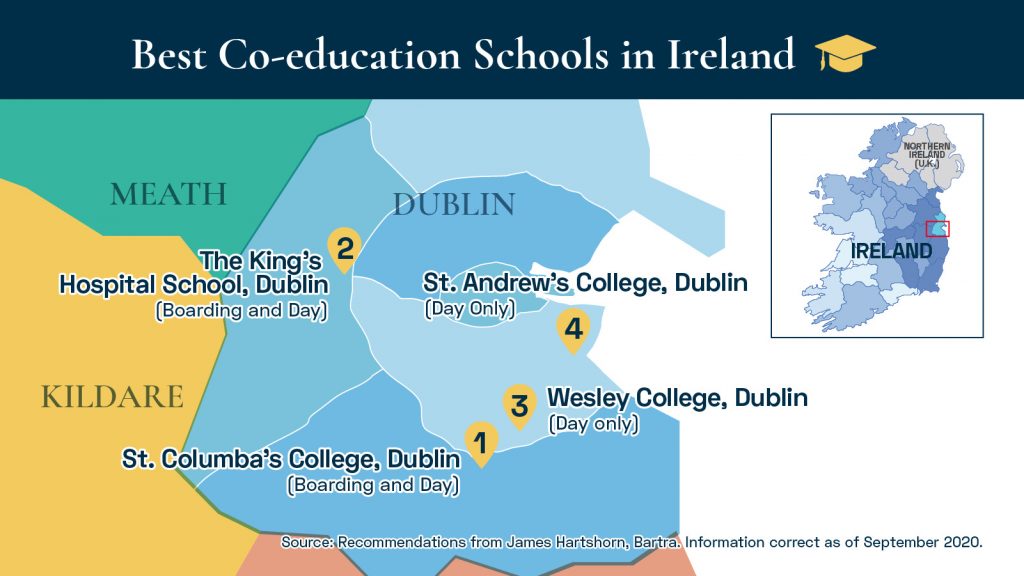

To learn more about studying in Ireland, watch the second episode in our video series Immigration Insights with Bartra Wealth Advisors, where Jeffrey Ling talks to Anthony Cheng, Director of the IIEC, about the most popular schools in Ireland, fees and budgeting, recognition of the HKDSE in Ireland, the best study years to transfer, and the leading degree programmes.

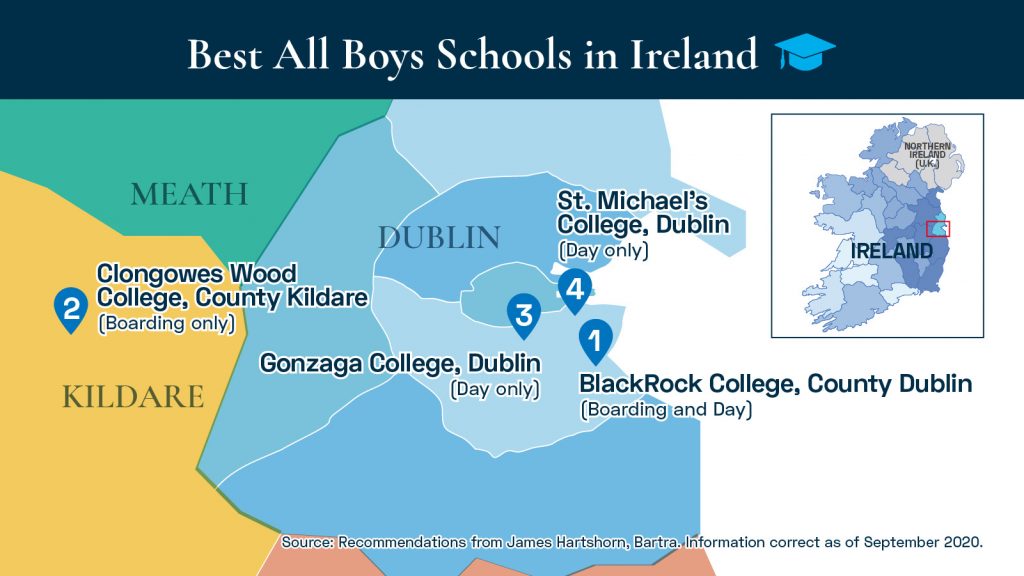

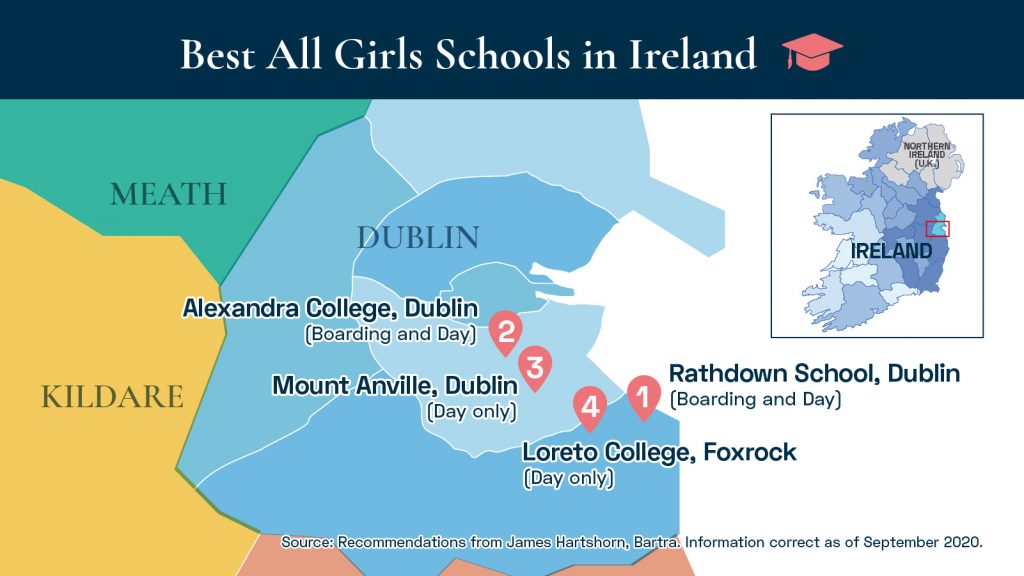

The UK and Ireland are home to some of the world’s most renowned and reputable schools at a secondary/boarding and tertiary level. By enrolling in a secondary or boarding school in the UK or Ireland, successful IIP applicants and their children will be close to top-tier universities in both countries and can conveniently visit university campuses and meet with faculty members and current students, which aids their decision-making process on which university will be most suitable.

In addition to attending world-class English universities, children who become citizens of Ireland can qualify as local university students and pay ‘home rate’ tuition fees instead of overseas rates.

For local, or ‘home’ university students, the typical tuition fee for an undergraduate degree at an English university is a maximum of £9,250 per year. Conversely, international students who plan to attend university in the UK and who are neither Irish nor British citizens have to pay the overseas rate, which could be as much as £26,000 a year. Without access to the ‘home’ rate, international students need to spend nearly three times more for the same undergraduate degree at the same university.

Similar to the UK, universities in Ireland follow a tuition fee structure whereby local students pay a local rate and international students pay an overseas rate. For instance, at the University College of Dublin and the National University of Ireland, Galway, charges for local students are €6,700 and €6,000 a year respectively for an undergraduate degree. An international student will pay €16,480 and €12,750 respectively for the same undergraduate degree at these two institutions – more than double that of their local classmates.

In addition to lower tuition fees, Ireland offers eligible university students funding support for their studies under the Free Fees Initiative. Qualifying students pay a contribution of just €3,000 per year, effectively receiving 50% off their fees, though one of the requirements is for students to be a national of either an EU Member State, a state which is a contracting state to the EEA Agreement, the Swiss Confederation, or the UK.

To learn more about Irish education, why not read our recent article What is it like to attend secondary school in Ireland.

Ireland is the only English-speaking country remaining in the EU following Brexit and, as such, Irish education will be highly sought after in the coming years, especially for students from EU countries who want to enjoy an English education and improve their language skills. If Ireland becomes the centre of EU education, it will be more effective in connecting with top colleges in various countries (including well-known universities in the UK). For students considering their options for further studes, enrolling in Irish universities offers plenty of opportunities. Generally speaking, Irish universities require IELTS scores of 6.0 to 6.5, and DSE scores of 44333 to meet the entry threshold, and they offer a diverse range of courses, from environmental science and veterinary medicine to creative arts and game design.

The IIP is more than a residency; it is a future for your children

The goal of many parents is to provide a better quality of life for their children and future generations. Investors keen to maximise opportunities for their children’s education and obtain residency rights in both the UK and Ireland should consider the Ireland Immigrant Investor Programme (IIP). The programme’s ability to provide educational benefits, such as a wealth of choice in top-tier secondary and tertiary schools and tremendous cost savings on university tuition fees, makes it the optimal pathway to an elevated lifestyle and opportunity-abundant future.

A country’s economic stability and quality of life are key deciding factors when selecting an immigration destination; it’s not just the broader career prospects. Finer details such as the study environment for children, the local tax system, healthcare services, the real estate market, affordability and cultural inclusiveness are among the important considerations – and Ireland is one of few countries that appeals across the board.

If you are interested in learning more about the Immigrant Investor Programme (IIP) and the education system in Ireland, get in touch now.