In an era marked by increasing globalisation and mobility, the allure of securing a second citizenship or residency through investment has never been stronger. Immigration by Investment (IBI) programs, which allow individuals and families to acquire residency rights or new citizenship in exchange for substantial financial contributions, have evolved considerably in recent years. In this article, we’ll provide an update on the latest trends, changes, and considerations in the dynamic world of IBI programs.

The Growing Popularity of IBI Programs

Immigration by Investment programs have gained popularity worldwide, and this trend shows no signs of slowing down. Several factors contribute to their appeal:

Global Mobility: IBI programs often grant visa-free or visa-on-arrival access to numerous countries, enhancing the freedom of global travel for investors and their families.

Family Future Planning for Enhanced Education and Global Vision: IBI programs are increasingly favored by families seeking to secure a brighter future for their children. These programs enable better educational opportunities and a broader international perspective for the younger generation.

Family Protection for Greater Residence Flexibility, Healthcare and Wealth Planning: IBI programs are also chosen for the invaluable protection they offer to families. This protection allows for enhanced residence flexibility, a higher quality of life, better healthcare and medical systems and comprehensive wealth planning – IBI programmes empower families to strategically plan their wealth, safeguarding their financial future. By diversifying their assets across borders, families can better navigate economic fluctuations and global financial challenges.

The growing popularity of IBI programs stems from their ability to serve as a cornerstone for family future planning, educational enrichment, global mobility, residence flexibility, and comprehensive wealth protection. This trend is set to endure as families increasingly seek to secure a better tomorrow for themselves and their children.

Recent Trends and Changes

The global landscape of IBI programs is witnessing notable transformations as countries adapt to evolving economic and security concerns, their IBI programs are experiencing significant shifts that are redefining the opportunities available to individuals seeking residency or citizenship through investment.

Due Diligence Enhancements: Many countries have taken steps to strengthen their due diligence procedures. These measures are aimed at ensuring that applicants meet high standards of integrity and suitability, with a particular focus on verifying the legitimacy of their capital. This enhancement is crucial for maintaining the credibility and security of IBI programs.

Family Inclusion: An emerging trend in IBI programs is the expansion of eligibility beyond primary applicants. Numerous programs now include family members, allowing them to also enjoy the benefits of residency or citizenship. This inclusivity provides more comprehensive opportunities for families seeking to relocate.

Shift Away from Real Estate Investment: Several countries have either raised or are considering raising the investment thresholds for real estate within their IBI programs. This shift is intended to ensure that investors make substantial contributions to local property markets or support rural areas to stimulate economic activity and job opportunities. In some cases, countries have even suspended the real estate investment route to prevent housing crises.

Reduced Availability of IBI Programs: There is a noticeable reduction in the availability of Citizenship by Investment (CBI) or Residency by Investment (RIB) / Golden Visa programs in various countries. For example, Bulgaria, the UK, and Ireland (with some investment options available until the end of 2023) have announced the closure of their programs. Additionally, some countries have reduced the quota for their Golden Visa programs, as seen in Australia. Furthermore, the reopening of suspended BIB schemes has been delayed in certain countries, including Canada.

In conclusion, the landscape of IBI programs is undergoing significant changes. These trends reflect a growing emphasis on due diligence, inclusivity for families, a shift away from real estate-centric investments, and reduced programs availability in certain countries. These developments are reshaping the options available to individuals seeking residency or citizenship through investment.

Specific IBI Program Updates

Among all the IBI programs, Residence by Investment (RBI) / Golden Visa programs have gained significant popularity among individuals seeking to secure a second home in a foreign country. These programs offer a pathway to residency and, subsequently, citizenship, with specific residency requirements for investors and their families, often in exchange for designated financial investments. In this section, we will compare RBI programs in five prominent countries: Canada, Australia, Ireland, the UK, and Portugal. Each program offers unique benefits and considerations, enabling prospective investors to make informed decisions.

Canada – Quebec Immigrant Investor Program (QIIP)

Investment Requirement:

- A minimum investment of CAD 1.2 million in an approved financial intermediary or by financing that investment for five years.

Minimum Net Worth:

- A minimum of CAD 2 million in legally acquired net worth, alone or with the help of their spouse or common-law partner if accompanying the applicant.

Benefits:

- Canadian residency provides access to excellent healthcare and education systems. It’s a pathway to Canadian citizenship and offers visa-free travel to numerous countries.

Considerations:

- A minimum of two years of management experience over the course of five years prior to the submission of the candidate’s application. The experience must have been acquired in a specific enterprise (agricultural, commercial, industrial), or in a government or international agency, and in a position defined as full-time.

Program Status:

- QIIP was initially suspended for review until April 2023, however, it’s further delayed until January 2024 with no specific timeline to re-open the program and new requirements may apply.

Australia – Significant Investor Visa (SIV) / Investor Stream (Subclass 188)

Investment Requirement:

- 188C: Invest a minimum of AUD 5 million in eligible ventures, small companies, and funds.

- 188B: Commit at least AUD 2.5 million to complying investments in Australia and maintain business/investment activity in Victoria.

Benefits:

- 188C provides a direct path to permanent residency.

- 188B offers a provisional visa with a pathway to permanent residency.

- Australia offers a strong economy, quality healthcare, and a high standard of living.

Considerations:

- 188C: Investment options carry inherent risks; applicants must meet health and character requirements. Genuine intention to live in the nominating State or Territory is required.

- 188B: Applicants need at least three years of management experience in qualifying businesses/investments, must reside for three years before applying for permanent residence, have an age limit of under 55, and score at least 65 on the SkillSelect points test.

Program Status:

- The Australian government has shifted its focus to skilled worker immigration post-pandemic, significantly reducing available quotas for Investor Visas.

UK – Tier 1 Investor Visa

Investment Requirement:

- A minimum investment of £2 million in the UK, with options to increase investments for accelerated settlement.

Benefits:

- The UK’s RBI program provides access to world-class education, healthcare, and business opportunities.

- It leads to permanent residency and citizenship.

Considerations:

- The program involves complex financial investments, and applicants must meet strict compliance requirements.

Program Status:

- Since the Home Office scrapped the Tier 1 (Investor) visa in 2022, a replacement visa route has yet to be introduced, allowing High Net Worth Individuals (HNWIs) to move to the UK through substantial investment.

Portugal – Golden Visa Program

Available Investment Options:

- Venture Capital Fund Investment: Capital transfers of €500,000 or more for participation units in venture capital funds (without real estate ties).

- Research Funding: Investment of €500,000 or more in research activities conducted by public or private scientific research institutions.

- Commercial Company Investment: Capital transfers of €500,000 or more for establishing a national territory-based commercial company or increasing the share capital of an existing company (with the creation of five permanent jobs).

- Cultural Heritage Support: Non-refundable investment of €250,000 or more in support of artistic production, recovery, or maintenance of national cultural heritage.

Non-Available Investment Options (No Longer Accepted):

- Capital transfers of €1,500,000 or more.

- Purchasing real estate valued at €500,000 or higher.

- Investing in the rehabilitation of real estate properties that are at least 30 years old, with a total investment of €350,000 or more.

- Investing in real estate in low-density areas for €400,000 or €280,000.

- Investing in funds with direct or indirect real estate investments.

Benefits:

- Portugal’s Golden Visa offers EU residency with a path to citizenship.

Considerations:

- An “official SEF source” indicates more than 7,000 pending golden visa applications, a significant departure from the SEF’s 10-year average of around 1,000 annual approvals. Clearing this backlog alone could take 6-7 years, pushing approval timelines past 2030 if new applications were suspended today.

- Investors should note annual government fees, legal fees, and tax representative fees per family member.

- A language test is required for Portuguese citizenship eligibility.

Ireland – Immigrant Investor Program (IIP)

Investment Requirement (popular options):

- A minimum investment of €1 million in an Irish enterprise or Investment Fund.

- A minimum €400,000 philanthropic donation to a project that benefits the arts, sports, health, culture, or education in Ireland.

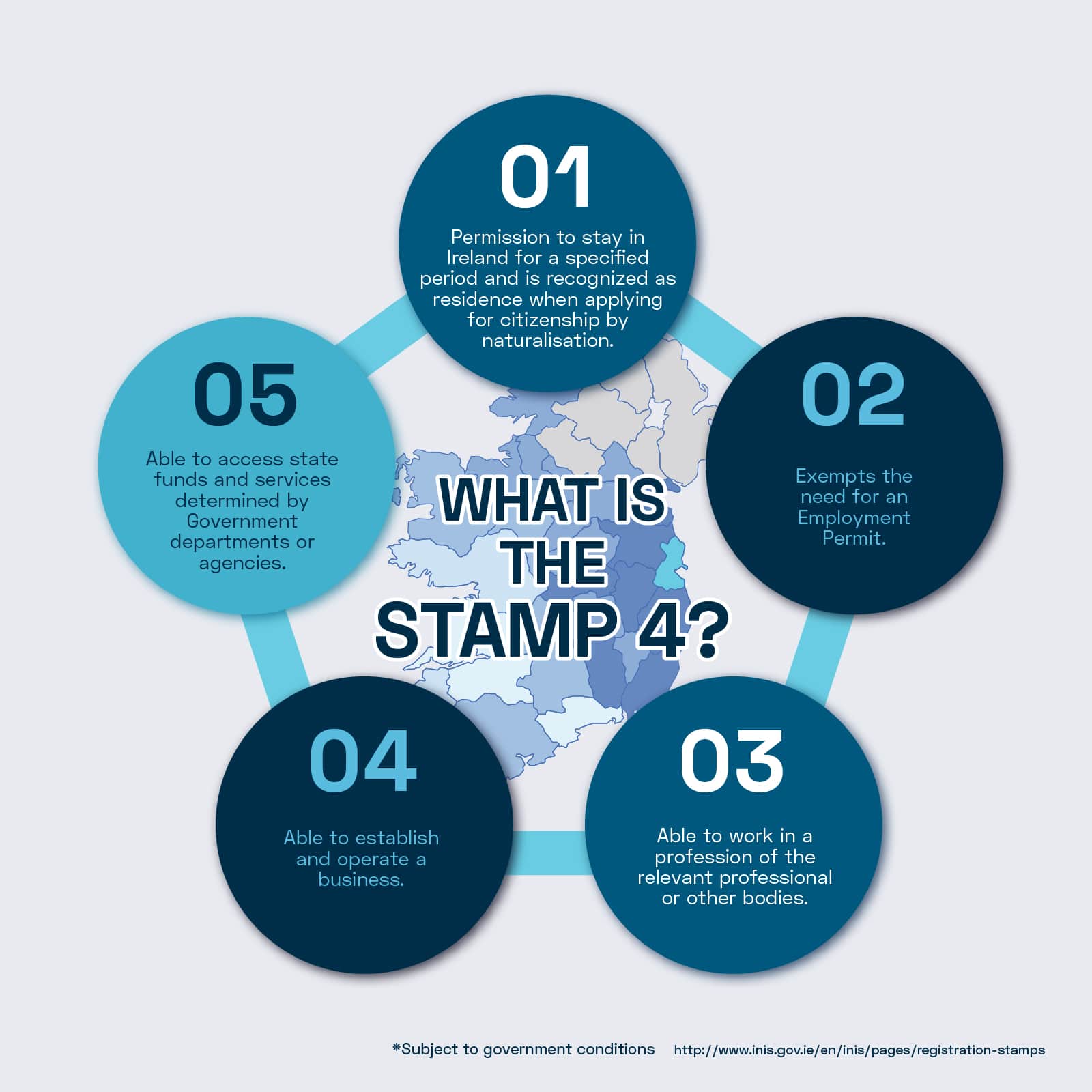

Benefits:

- Ireland offers a stable economy, an English-speaking environment, and residency in both the EU and the UK.

- It provides a direct pathway to permanent residency with the potential for citizenship through naturalization, without the need for a language test, medical test, educational level, or age limit.

- Investment can be made after receiving a pre-approval letter following the application.

- The program offers the most flexibility for residency (only one day per year required), resulting in significant tax planning benefits for investors among English-speaking countries.

Considerations:

- The Irish government announced the closure of the IIP in February of this year.

- Only approved IIP projects can continue to accept investors for applying to the IIP with a grace period, and the available quotas are very limited for Enterprise investments and Endowment options.

- An extension has been granted to the Investment Fund option offering the IIP, allowing it to run until the end of 2023. Regulated by the Central Bank of Ireland, this low-risk investment fund route has received special permission to continue processing applicants for the IIP until December 31 of this year.

- Bartra Wealth Advisors specializes in Irish immigration, providing one-stop-shop solutions by assisting investors from initial consultations and applications to landing services and investment exits. We currently have limited IIP slots available for investors who have immediate application intentions.

Conclusion

Immigration by Investment programs continue to evolve, offering a pathway to enhanced global mobility, economic opportunities, and an improved quality of life. As countries adapt to changing circumstances and investor needs, staying informed about the latest trends and changes in IBI programs is essential for those considering this life-changing opportunity.

The choice of a Residence by Investment program depends on individual goals, financial capabilities, and preferences. Each country’s program offers distinct advantages, such as access to strong economies, high-quality living standards and educations, and pathways to citizenship. It is crucial for prospective investors to conduct thorough research, seek legal and financial advice, and carefully evaluate the unique benefits and considerations of each program before making a decision. With the right choice, investors can secure not only a second residence but also a brighter future for themselves and their families.

-1005x1024.jpg)