In our previous article, we discussed four important things to be aware of post-Brexit. But the UK-EU deal presents opportunities, too.

From 1980 to 2020, Europe’s five largest economies have consistently been France, Germany, Italy, Spain and the UK. However, as COVID-19 has raged through Europe and the UK has departed from the European Union, many EU nations are facing deep recessions, with the economy of the EU forecast to contract by a record 7.4% in 2020.

Meanwhile, Ireland’s star has been rising. Ireland remains a strong and committed member of the EU post-Brexit. Politically, it is taking its place among the nations of the world. On a per-head basis, Ireland has a good claim to be the world’s most diplomatically powerful country. In July 2020, the 19 finance ministers of the eurozone elected Irish finance minister Paschal Donohoe to be the president of their influential Eurogroup, putting Ireland in a powerful position as the EU debates ways to deal with the economic fallout of the global pandemic. In October, the EU appointed Ireland’s Mairead McGuinness as the new commissioner in charge of financial services. Ireland also won a place on the UN Security Council, securing one of the ten rotating seats to join the five permanent members that include the US, UK, Russia, France and China.

Economically, Ireland remains a popular choice for investors looking to access the European market. With a low corporate tax rate of 12.5% (among the lowest in Europe) and favourable tax system, Ireland is a highly sought-after location for foreign investment and businesses. While the Global Financial Crisis caused a contraction in Ireland’s economy, which had been flourishing for the decade prior, it has regained its stability and for the past six years has been one of the strongest developed countries in Europe. And in terms of quality of life, Ireland ranked joint second with Switzerland, beating Sweden, Germany and the UK.

With a Brexit deal now agreed between the UK and the EU, Ireland appears to be the land of opportunity, particularly when it comes to global competitiveness. Here are four important elements to consider:

1. Business and employment

The Irish Government has continued to demonstrate its commitment to Foreign Direct Investment (FDI) by establishing a business environment that is conducive to FDI activity and Ireland remains a location of choice for many of the world’s leading companies. Indeed, more than 1,100 companies, including many of the world’s leading brands, have decided to place Ireland at the hub of their European operations. Additionally, 70 individual investments related to Brexit, with more than 5,000 associated jobs, have been approved since the UK’s EU referendum in June 2016, according to Ireland’s Foreign Investment Agency, IDA Ireland’s 2019 figures.

Cityscape of Dublin Docklands and river Liffey with modern buildings and barge on river. To date companies that have announced investments in Ireland connected to Brexit include Barclays, Morgan Stanley, TD Securities, Wasdell, Delphi/Aptiv, Simmons & Simmons, S&P Global, Thomson Reuters, Equilend and Coinbase. And Dublin remains the most popular destination for financial services firms to relocate to post-Brexit according to EY’s Brexit Tracker.

Besides the financial sector, Ireland is home to 9 of the top 10 global pharmaceutical companies, including Pfizer, Johnson & Johnson, Roche and Novartis. It is also the base for many US Tech titans; IBM was the first US tech firm to set up in Ireland in 1956, with Google, Microsoft, Intel, Apple and Facebook moving in more recently. Last year, Apple celebrated 40 years of continued investment and reinvestment in Cork.

“For US companies with ambitions to be global players, Ireland is a natural fit for their international operations,” said Martin Shanahan, CEO of IDA Ireland. According to IDA, 245,096 people were directly employed in the multinational sector in Ireland in 2019, representing about 10% of the Irish labour force.

Although the US remains Ireland’s largest overseas investor, investments into Ireland from China have surged in recent years. According to the Rhodium Group, FDI from China into Europe declined in 2019, but the opposite was true for Ireland. Figures from Baker McKenzie show that investment from Chinese companies rose 56% in 2019 through various M&A deals and expansions, meaning the world’s second-largest economy is becoming increasingly important to Ireland. Among these, Huawei announced a €70 million ($76.7 million) investment into research and development in Ireland in 2019, while in 2020 TikTok announced its plans to build €420 million ($500 million) data centre in Ireland.

The presence of foreign/international companies helps to create strong job markets which are crucial to immigrants. With more job opportunities in professional sectors, immigrants and any graduate children do not have to sacrifice their professional career and remuneration. With an increasing number of multinational firms, this could see the country open up.

2. Favourable market environment

The EU’s Single Market environment, together with the adoption of the Euro and support from the combined power of 27 Member States, have strengthened the Irish economy and allowed it to flourish. Ireland is now a nation with a modern economy based on free trade, foreign investment and growth.

It also has one of the most favourable tax regimes in the world, attracting hundreds of foreign companies. This is strengthened by the government’s long term commitment to its 12.5% corporate tax rate.

Language is vital for communication. And English is now the global language of business as well as being spoken at a useful level by some 1.75 billion people worldwide – or one in four people. Multinational companies are increasingly mandating English as the common corporate language. For two decades, English has been the ‘lingua franca’ of EU institutions in Brussels, used by EU policymakers to communicate about laws regulating subjects like energy, security and trade. After Brexit, Ireland will be the only Member State where English is spoken as its first language.

Ireland may have EU membership, a favourable tax system and a global first language, but it’s keen to offer more to boost its growth and productivity. The nation is currently updating its rules around private funds to encourage more alternative investment managers to use the country as a base for their European operations. The rules have been designed to appeal to private fund managers based in the UK who will lose the “passporting” rights that have allowed them to sell investment products across the EU pre- Brexit. Ireland is already Europe’s second-largest fund centre with more than 560 international managers using the country as a domicile from where they can sell their products across Europe and Asia, and this will only increase its appeal. Managers that establish Irish investment limited partnerships will be granted more flexibility when establishing private equity, private credit, venture capital, infrastructure, renewable energy and real estate funds under legislation which was approved in December 2020 in the Dáil, the Irish parliament. The reforms are expected to create several thousand jobs and new income streams for service providers. Currently, more than 16,000 staff are directly employed in Ireland’s fund industry including portfolio managers, administrators, trustees, auditors, compliance, legal and tax advisers.

3. Freedom of movement – UK and EU

Ireland remains a vital member of the EU and continues to benefit from the union’s economic and political stability. As EU citizens, Irish nationals can continue to live and work freely in any EU Member State and Irish citizens continue to enjoy other privileges, such as access to the European Health Insurance Card that provides them with healthcare while traveling throughout the EU. Students belonging to Irish institutions have access to the Erasmus+ programme and the right to study in the EU. Other perks for Irish nationals include waived mobile phone roaming charges when traveling within the EU.

Ireland will be the only bridgehead into both the EU and the UK following Brexit. The Common Travel Area (CTA) is a long-standing arrangement between the UK, the British Crown Dependencies (Jersey, Guernsey and the Isle of Man) and Ireland that pre-dates both British and Irish membership of the EU and is not dependent on it. Under the CTA, British and Irish citizens can move freely and reside in either jurisdiction and enjoy associated rights and privileges, including the right to work, study and vote in certain elections, as well as to access social welfare benefits and health services.

Thanks to its strategic relationships with the EU and the UK, and the freedom of movement that these provide, many international companies see Ireland as an important gateway to both the UK and Europe.

4. The popularity of Irish residency and citizenship

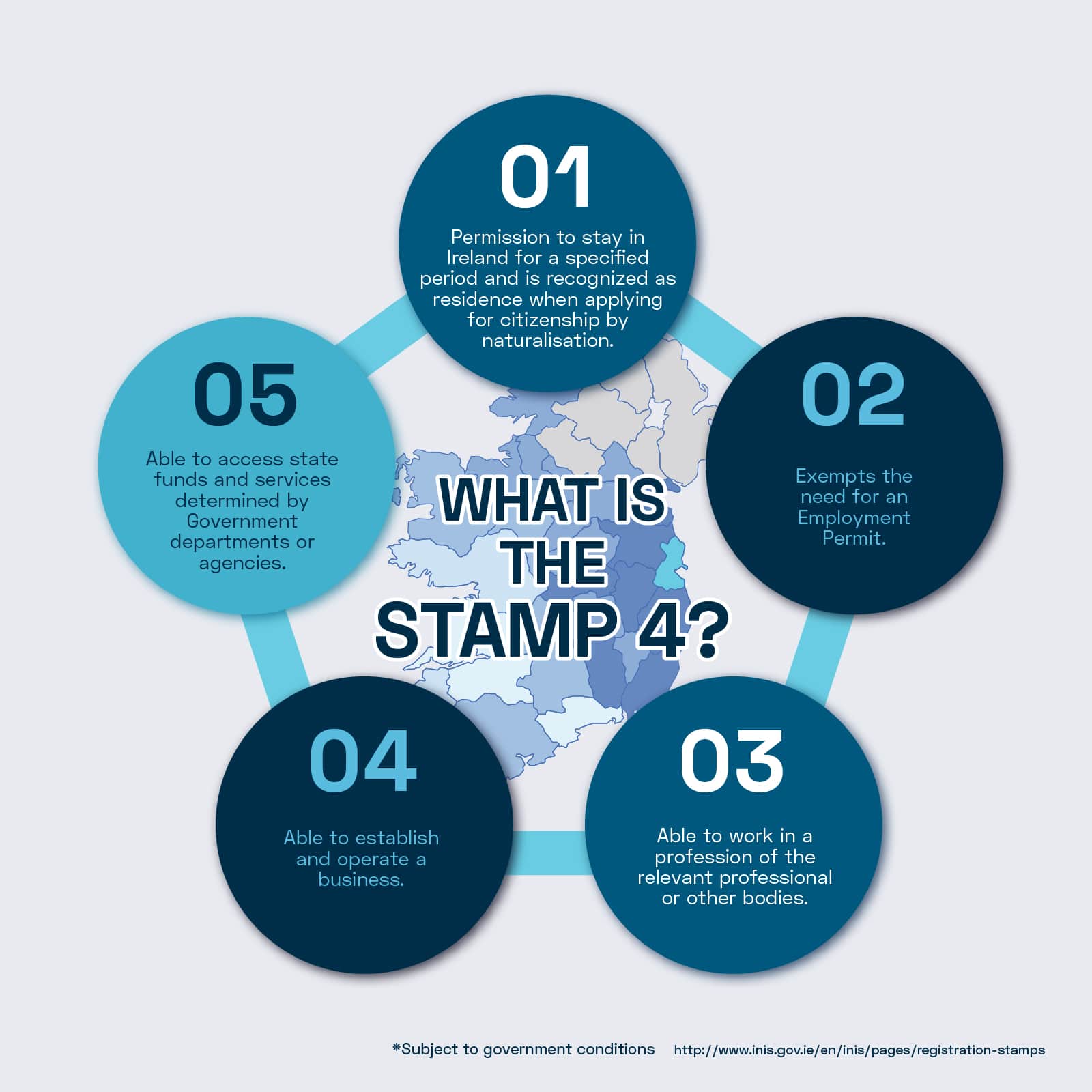

As Brexit sees the UK and EU go their separate ways, EU nationals residing in the UK must now apply for settlement, while UK citizens residing in the EU must follow suit and obtain resident permits. But there’s an exception – the Irish. And for this reason, Irish residency and citizenship are becoming increasingly attractive.

In particular, the Irish Investment Migration Programme is gaining popularity among wealthy individuals, not just because of its links to the EU and UK, but also due to its safety and simplicity. Compared to other Golden Visa programmes in Europe, the Irish Investor Immigrant Programme (IIP) outshines its peers. When investing in enterprises under the IIP’s investment options, the required holding period of 3 years is low compared to other European investment migration options (Greece, for example, requires an indefinite holding period), while the exit strategy is simple and straightforward without the need to liquidate investments; you simply get your money back. The IIP also only requires investment after approval, and unlike in other countries where the investment is required in real estate, investments in the IIP are hassle-free when it comes to exiting with no need for property management firms to rent out properties for ROI, nor the need for brokers to find buyers once the holding period is over. IIP makes the Irish immigration process simple, clean and efficient. To find out more, read about the Irish Investment Migration Programme on IMI.

Obtaining Irish residency in the most durable bridge between two of the strongest economies in the world, the EU and the UK, following Brexit, and is undoubtedly a wise move for international investors. This is something which the IIP sets the stage for in 2021. And we believe that interest in the IIP will only increase as businesses and affluent individuals recognise the personal and professional advantages of maintaining a foothold in Europe, and foresee strong demand from China, Hong Kong, Vietnam, India and the UAE, as well as interest from South Africa, Canada and the UK.

To find out more about our IIP, please do not hesitate to get in touch. Missed Brexit and beyond Part 1? Click here to read.