Bartra Wealth Advisors has won the Supreme Brand of Overseas Investment & Immigration Consultant Firm Award 2020, organised by CAPITAL CEO X Entrepreneur. The awards ceremony took place on 27th November at Island Shangri-La Hong Kong.

Mr. Jeffrey Ling, Regional Manager shared, “Thank you CAPITAL for the award. We are honored and grateful to have the industry recognition for our brand and service, and have the opportunity to participate in this awards ceremony with all the award-winning companies on the stage.

Throwback to about the same time last year when we were literally starting our business in Hong Kong (August 2019), although we are one of the largest, leading developers in Ireland who are also the only developer can provide Hong Kongers with direct Ireland investment immigration services, to deliver great businesses results in just one-year time it wasn’t easy, coupled with the challenging global economic environment and the pandemic’s impacts.

Thankfully, our real estate investment projects are safe with a simple investment process. We have a transparent and open investment environment, a great team of dedicated professionals, plus having the advantage of the growing economy in Ireland in recent years and its more important place amongst the nations of the world, this year’s achievement is remarkable.”

He added, “We are thrilled to win the brand award. There’s a tremendous amount of effort required behind a successful brand, from products to services. It requires everyone to have the same belief, be insistent and persistent. Every time when we hear clients thank us for our help, have their trust and their recognition of our products and services, our energy and confidence are increased.

Thanks again to everyone and the award, we will continue to strive to be better!”

Upper left corner picture, from left to right: Regional Manager Jeffrey Ling, Sales Manager Tanya Wong, Marketing Director Jay Cheung and Business Development Manager Alan Lau. Lower left corner picture: Regional Manager Jeffrey Ling was receiving the award from Deputy Chairman of the Hong Kong Institute of Directors Mr. Edmund K H Leung.

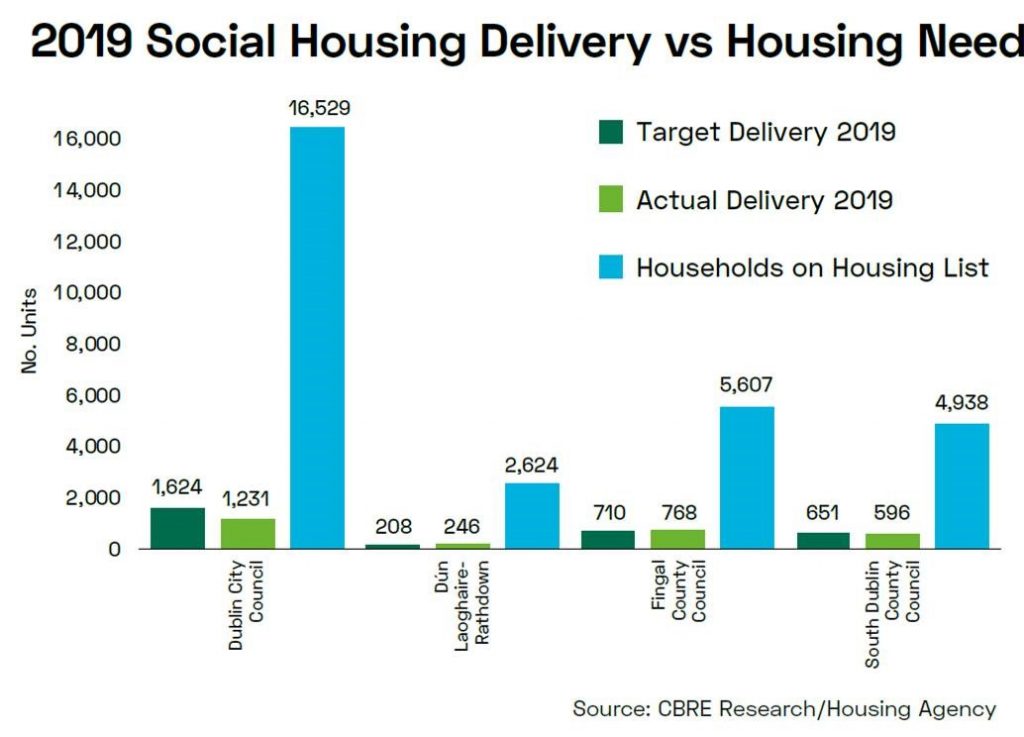

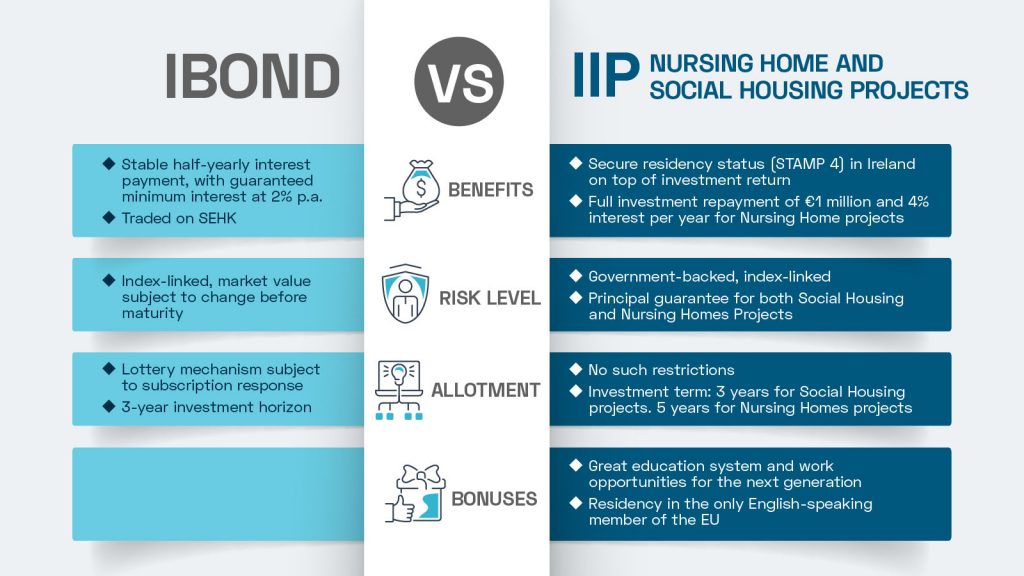

Bartra Wealth Advisors Ltd is a subsidiary company within the Bartra Capital Ltd Group of companies. As the immigration arm of Ireland’s most successful real estate developer Bartra Capital, Bartra Wealth Advisors provides investors direct access to high-quality Nursing Home and Social Housing projects as the preferred investment options designated by the Irish government for the Immigrant Investor Programme (IIP). With a well-established business, extensive Irish immigration experience, expertise in real estate investments, professional landing teams and strong business network support, Bartra Group has helped hundreds of families successfully immigrate to Ireland.

Bartra Wealth Advisors prides itself on delivering streamlined, in-group, end-to-end services. Its unique business model supports clients throughout their investment and immigration journey, from immigration advisory and government backed IIP projects through to successful investment exits. It maintains a 100% application approval rate as well as 100% renewal rate.