Social Housing and Nursing Home markets

Not just in Hong Kong, but everywhere else in the world, we see a high demand for and a shortage in Social Housing and Nursing Homes. This puts a lot of pressure on the government and the people, but it means there are great potentials in these projects.

Beaumont, our biggest nursing home project to date, has just finished construction ahead of schedule and will now enter the HIQA inspection phase.

The fact is, the investment in these markets have well been the trend in Europe and the UK. This is because they receive guaranteed long-term secure income streams from a local authority or an Approved Housing Body. This makes it particularly appealing to institutional investors and pension funds, as investors get to enjoy long-term leases with little or no day-to-day management, repair, or maintenance responsibility.

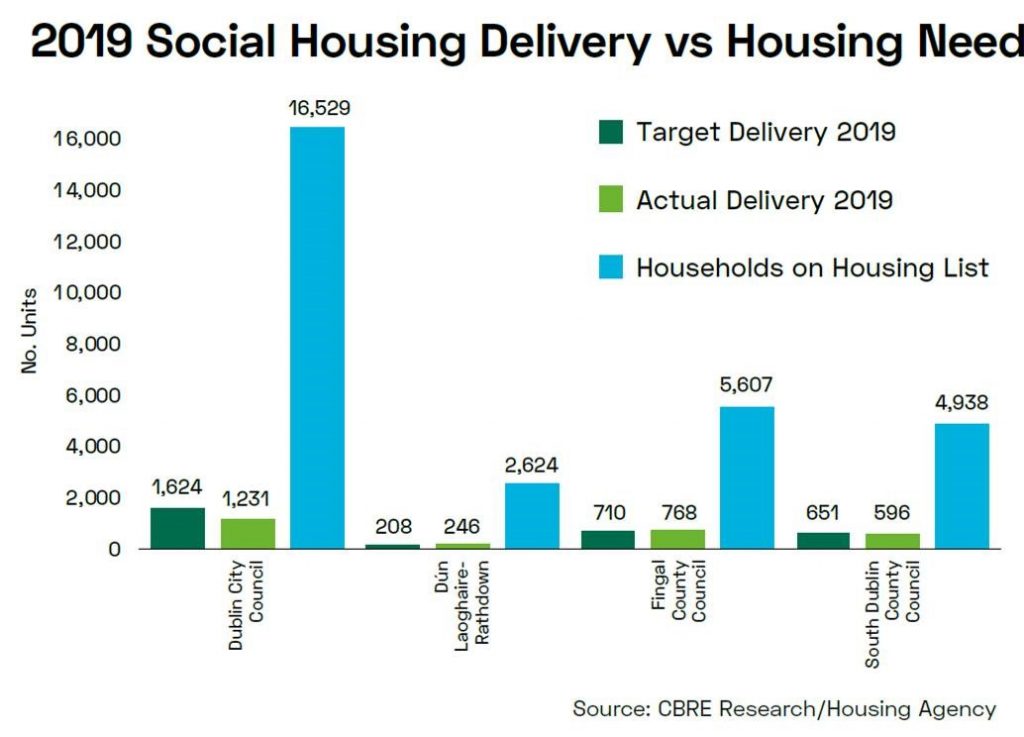

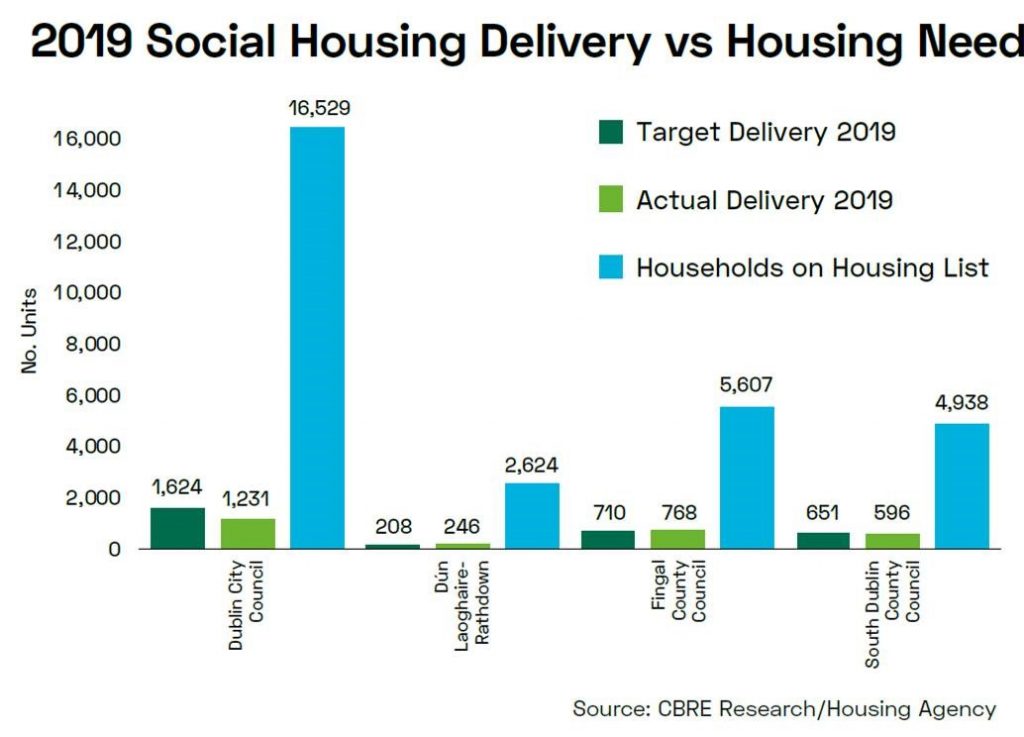

Such growth is seen in the Social Housing market in Ireland and is reflected in the CBRE Group report for the past six months. In Ireland, there are a total of 68,693 households waiting to be housed. However, no more than 15,000 are likely to be developed in 2020.

With its ageing population, the undersupplied Nursing Homes are also seeing strong demands in Ireland. The percentage of over 65-year-olds is expected to reach 16% of the total population, accounting for 860,600 people. This means the country will need 7,500 new nursing home beds in the system by 2020. However, very little is expected to be built in the next few years, resulting in only the 1,144 beds which are currently on site.

To meet the required volume of units and to reduce the housing waiting lists, the collaboration between the public and the private sector to increase the delivery of much-needed Public Housing and Nursing homes is essential.

The role of our Irish Immigrant Investor Programme

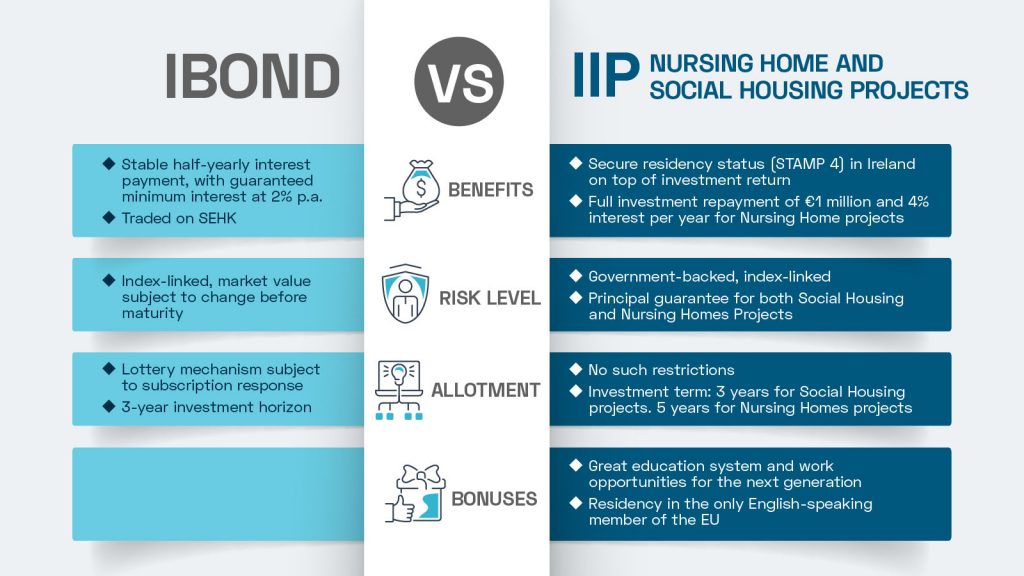

As a developer who has successfully carried out many social housing and nursing home projects, we offer these projects as the Enterprise Investment route for families who are considering immigration to Ireland under our Irish Immigrant Investor Programme (IIP). Our extensive Irish immigration experience and expertise in the investment field, as well as our strong business network of partners, have allowed us to maintain an application approval rate of 100% and a 100% renewal rate.

Applying for Irish residency via IIP is very straightforward, with short processing times and no quotas. Investment in Nursing Homes, in particular, offers Hong Kong investors capital protection with a potential profitable return. We offer a five-year term with a 4% annual return for Nursing Home investments. More importantly, we offer end-to-end services, so you can be sure that your investment and your family’s future is in safe hands all the way through the process.

Why Bartra?

We at Bartra only market investments where we have already purchased the site. All of our projects are located in Dublin, the area of highest investor demand, and long term value. We only use high-quality design team members including architects, planners, quantity surveyors, and construction companies. All our projects are fully cost by independent third parties prior to being marketed to IIP applicants. The investments are structured so that there is a clear alignment of interest between investors and Bartra, that the projects are only profitable for Bartra if they are first sold and investors are repaid.

Bartra Group already has a pipeline of 435 Social Homes with a value in excess of €130 million at the moment. We are planning to construct more than 1200 homes in the next 5 years. Our Social Housing project at Poplar Row has just signed a 25-year Enhanced Lease with the government. At a 0.14 hectare size with 39 apartments, the construction started in June 2020 and is progressing on time. Our other Social Housing projects are also debt funded by various companies. Bartra Group also has a pipeline of 823 Nursing Home beds and plans to run over 1,000 beds in the next 5 years. One of our projects, the Loughshinny Nursing Home Development, has been completed and was opened in summer 2019 with residents moving in. It has also shown full compliance across all areas in the HIQA report, which is hard to achieve. Also, our Northwood project has officially opened in late May this year, with occupants moved in.

Fast becoming one of the largest providers of Social Housing and Nursing Homes in Ireland, our available IIP project slots are filling up quickly. Speak with one of our expert advisors to find out more about Bartra Wealth Advisors and our projects by completing the form below, and see how you can be a part of our projects.