When it comes to major types of real estate investment, the obvious contenders are residential property and commercial real estate. Therefore, it might come as a surprise that social housing has actually become one of the most popular investment options in Ireland in recent years.

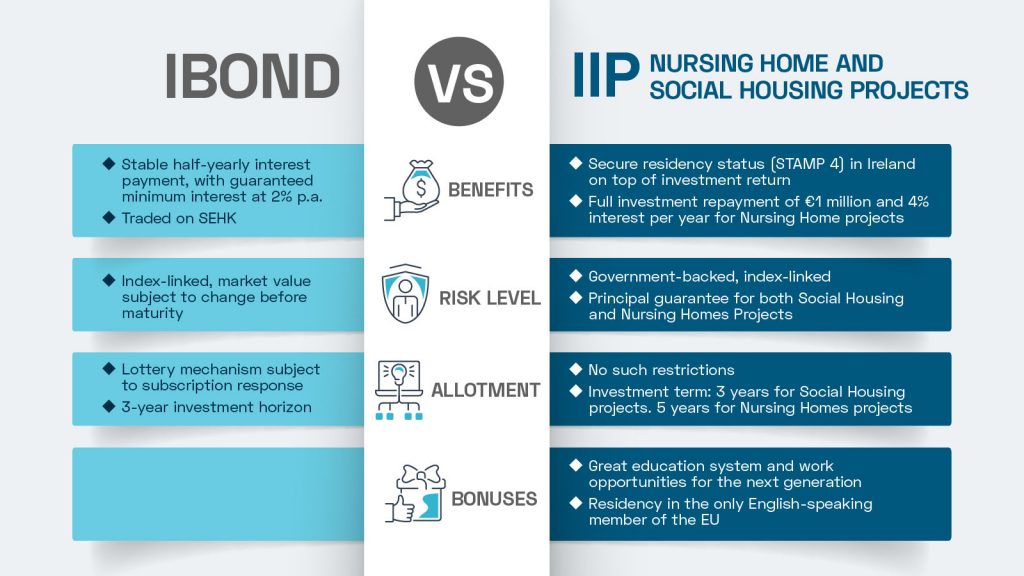

Although it is difficult for individual investors to participate, there is the opportunity to participate in Bartra’s social housing projects through the Immigrant Investor Programme (IIP). At maturity of your three-year investment period, your total €1 million investment will be returned, along with Permanent Residency status for you and your family.

According to CBRE’s Ireland Bi-Monthly Research Report published in May 2021, the Irish social housing market continues to record large transactions, including the recent sale by Ardstone Capital of a portfolio of five multifamily and single-family assets for €450 million, and the acquisition of 39 units leased to Dublin City Council at Blackhall Street in Dublin 7 for €20 million. The report also noted that several annuity funds and impact funds are now specifically targeting opportunities in this sector, and the social housing market is expected to thrive going forward. So, why are so many institutional investors keen to invest in this sector?

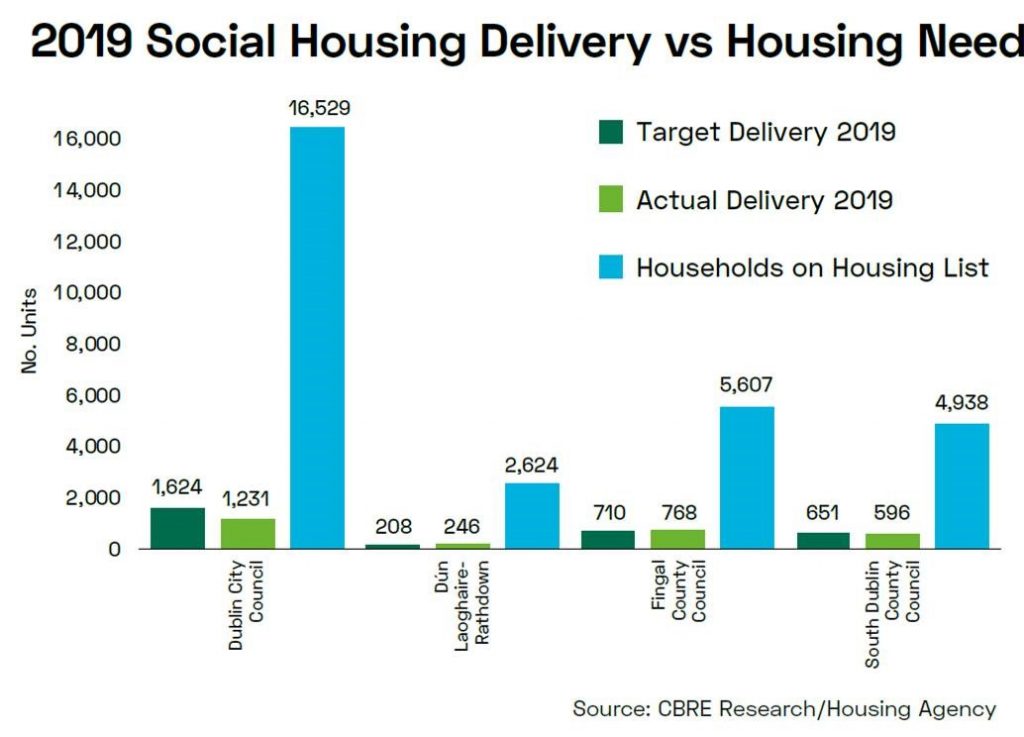

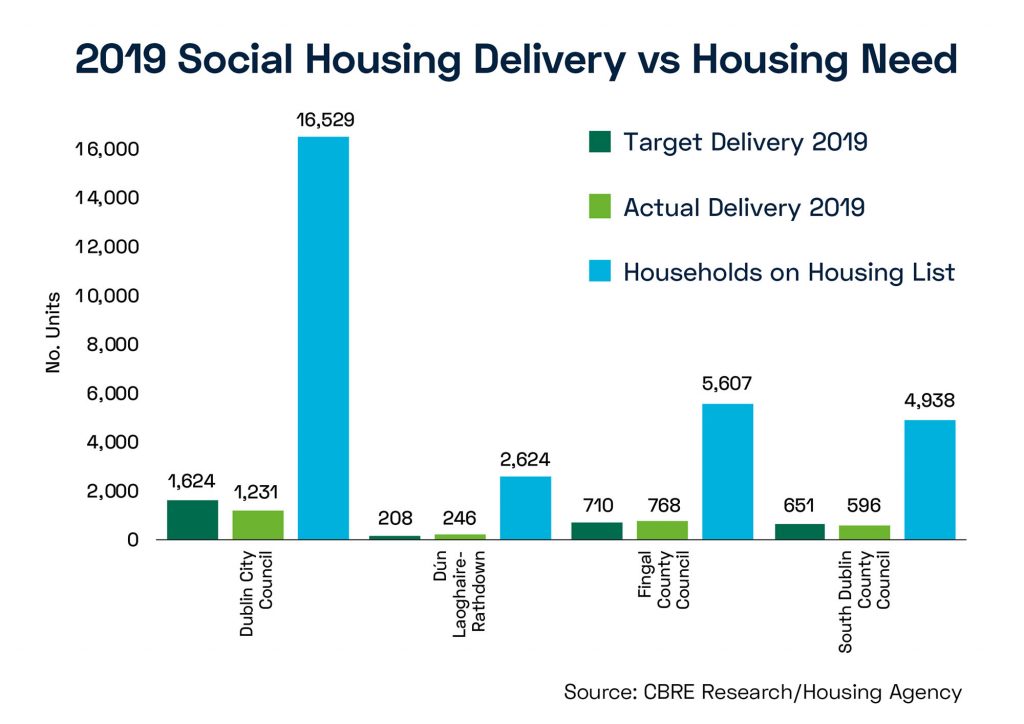

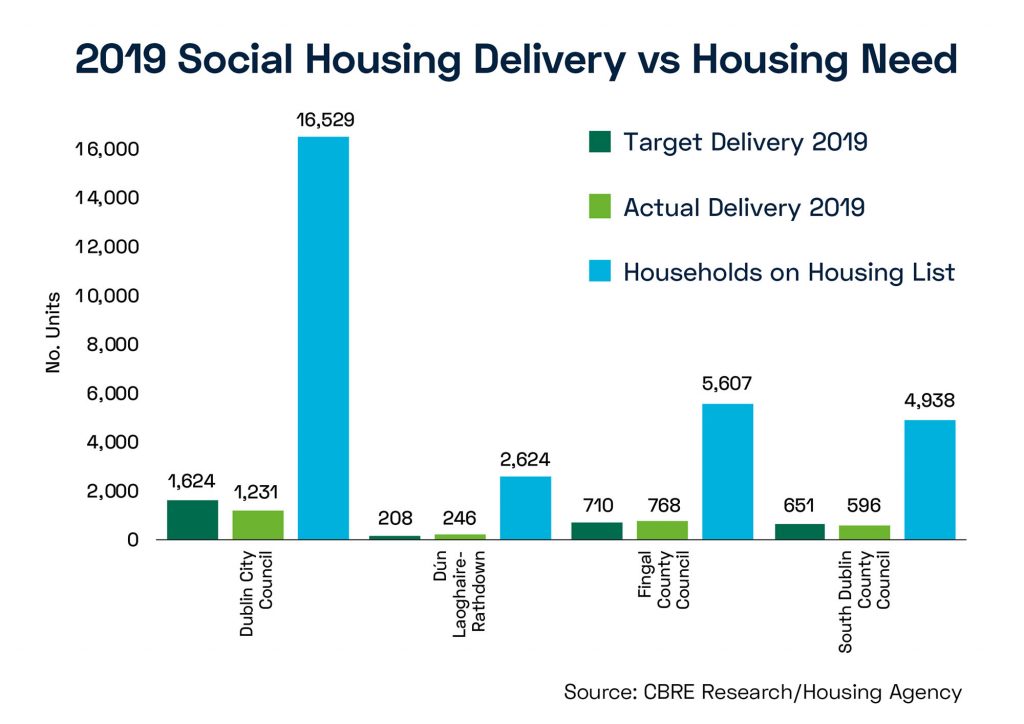

Data published in November 2020 showed that there were 61,880 households on the housing list in Ireland, while only 9,028 social homes are currently onsite. The social housing supply falls far short of demand, not to mention that last year’s pandemic battered global construction sectors with Ireland being no exception. The likelihood is that the housing list is now considerably longer than the data published.

The undersupply of social housing did not happen overnight. A significant legacy of the 2008 financial crisis was substantial under-investment in Ireland’s real estate projects, causing the real estate supply to plummet.

Ireland’s economy has regained its momentum in recent years and maintained the highest economic growth rate in Europe for six consecutive years. Thousands of migrants are flooding into this new European financial centre, especially Dublin, and this has further encouraged a rise in rent and demand for private and social housing.

Long Term Social Housing Leasing Scheme

To accelerate social housing delivery, the Irish government has committed more than €6 billion under the “Rebuilding Ireland” campaign. Under Rebuilding Ireland, one of the targets is to deliver 50,000 social housing units by 2021, of which 33,500 units will be exclusively built as social housing, 6,500 units will be acquired from the market, and the remaining 10,000 units will be secured via lease agreements. In other words, the Irish government is encouraging property developers to build properties and lease them to the government.

The standard leasing scheme offers a lease term of 10-25 years. The Irish government (the lessee) will pay 80-85% of an agreed market rent which will be reviewed every three years and is linked to the Harmonised Index of Consumer Prices (HICP), an indicator of inflation harmonised across EU countries.

In 2018, the Irish government launched the Enhanced Long Term Social Housing Leasing Scheme as an addition to the existing leasing arrangements. The enhanced scheme offers a 25-year lease term with up to 95% of the agreed market rent, but in return, each proposal has to include a minimum of 20 property units, and the lessor (developer) is obliged to provide management services.

Bartra was interviewed on RTÉ One, Ireland’s national broadcaster about Government long term leasing of social housing

Backed by the Irish government, the leasing scheme provides high investment stability for social housing investment.

Bartra’s Social Housing Projects

As one of the leading developers in Ireland, Bartra is committed to providing high-quality social housing for families in need. All of our social housing projects are located in Dublin and are constructed by seasoned professionals including architects, planners, quantity surveyors, and construction companies. Majority of our projects will be leased to the Irish government for 25 years, therefore the income is guaranteed.

EN-964x1024.jpg)

EN-964x1024.jpg)

Bartra’s latest social housing development is Colmcille House, in Stoneybatter, Dublin 7. Completed in April 2021, the development is located in a prime area of Dublin, within walking distance of Smithfield LUAS stop, and offers a total of 23 apartments situated less than 2km from the city centre. It has wonderful views over the city. At Bartra, we believe that every resident deserves a high quality of life, so every unit in Colmcille House is beautifully designed and 15-20% larger than most apartments in the area.

Bartra’s complex in Stoneybatter was funded by the IIP

Contact us to learn more about our social housing projects and the IIP programme.