Covid-19 and the global pandemic have battered economies around the world. Yet some have fared better than others. Ireland has proved resilient, recording economic growth and strong demand in other sectors of its market, such as real estate. Here, we look at how the nation has fared and what we can expect going forward.

Economy

Of all the EU economies, Ireland’s was the only one that recorded economic growth in 2020. GDP expanded by 3.4% according to the Central Statistics Office Ireland, despite falling 6.3% in the EU overall (and by 6.8% in the eurozone). This growth was largely driven by the export sector as many US companies use the country as a gateway to Europe. The domestic economy was less rosy, with demand shrinking 5.5% in 2020 and household consumption dropping 9%.

The economy’s growth is expected to continue in 2021, despite a tough first quarter thanks to lockdown in December and January as well as Brexit, though predictions suggest that it should regain its momentum with 3.5% growth expected for 2021, which should continue in 2022, as estimated by the EU.

As well as the wealth of multinationals and large US companies that have made Ireland home, the country is also benefiting from the fallout from Brexit with Dublin the most popular city for relocations by financial firms. According to EY, Dublin has seen almost 7,600 job relocations from Britain since the referendum, with 36 firms saying they will or are considering relocation to the city, of which nine are universal banks, investment banks and brokerages, 18 are wealth and asset managers and six are insurers or insurance brokers.

As a gateway to Europe and an attractive alternative to Britain now it is no longer a member of the EU, Ireland also offers a competitive tax regime that is comparatively appealing as a location for business. And the nation appears committed to maintaining its 12.5% corporation tax rate, according to KPMG, keen as it is to ensure that its tax system remains competitive, fair and sustainable, and ultimately attractive for business.

The tech sector also continues to thrive, boasting international tech companies including IBM and Microsoft as well as a burgeoning startups sector. The focus for many of these companies is deep technology as well as areas such as quantum computing, AI, robotics and IoT. Additionally, Trinity College Dublin launched a “world-class” AI accelerator programme in February 2021 to support early-stage AI businesses in the areas of Retail, Digital Health, FinTech, InsurTech, Regulatory, and Compliance, with a vision to help Ireland become a leader in using AI technology to benefit citizens and society.

Tech and Ireland continue to become increasingly interlinked. The new darling of Silicon Valley, Stripe looks like the latest company to give Dublin’s fintech sector a boost, as its founders, San Francisco-based Irish brothers Patrick and John Collison, plan to use the company’s latest USD600m funding to fuel expansion in Europe. This includes hiring 1000 more people in the company’s Dublin office over the next five years.

According to Fitch ratings, Ireland’s economic outlook is stable, with long-term foreign-currency IDR at ‘A+’ and governance and human development indicators comparing favourably with both AA and A medians. While the country is subject to elevated levels of public debt and risks around the uncertainty caused by Brexit, the effect of the pandemic is expected to be mild with pre-pandemic GDP growth boding well. Ireland’s 2021 budget includes an expansionary policy package of around EUR17.75 billion, which amounts to 4.6% of forecast GDP, including strong increases in health spending and capital expenditure, as well as a reserve of EUR5.5 billion available for further economic support if required.

Property Market

Ireland’s property market dictates the attractiveness and competitiveness of the country as a location for business, as cost of living is a key factor for prospective companies looking for a foothold in Europe or outside of Britain.

The last year has seen growth for some property sectors in particular, including the multifamily and private rented sector, social housing, industrial and logistics, and data centres, according to CBRE’s Ireland Real Estate Market Outlook report. Retail and hotels, on the other hand, understandably struggled as a result of the Covid-19 pandemic.

Predictions for the year ahead see a focus on core assets in the office, industrial and residential sectors, with some looking towards alternative niche investment sectors, such as social housing, healthcare, data centres and life sciences, according to the same report.

Residential investment in the multifamily sector accounted for 48% of total investment spend last year. The balance of supply and demand in this sector worsened in 2020 – less than 20,000 housing units were delivered during the year demonstrating that supply of both public and private housing has come on stream at a very slow pace, while demand continues to outpace it. Therefore, investor interest continues to grow. The imbalance between supply and demand has also supported rental growth – prime yields remained unchanged at 3.75% in 2020 despite the challenging economic backdrop.

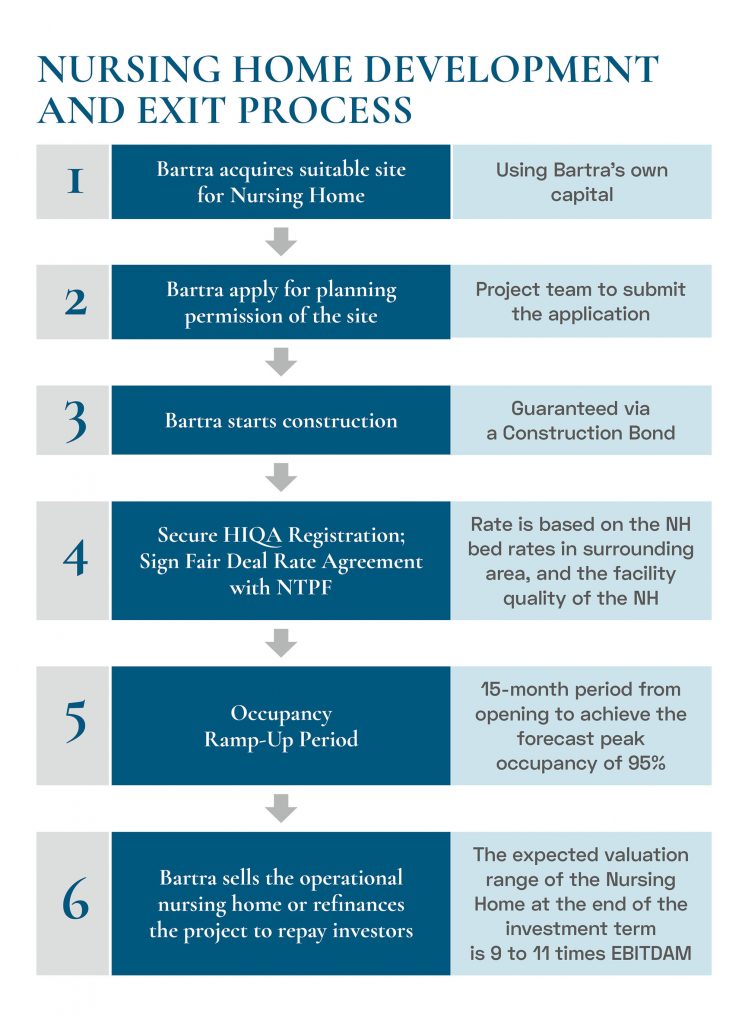

With an ageing population, investors continue to be attracted to nursing homes in Ireland. CSO data released last year showed that 14.5% of Ireland’s population are now aged over 65, marking an increase of 11.3% from a decade ago. This is expected to rise in the coming decade. By 2036, Ireland’s population aged over 80 is expected to rise from 170,000 in 2020 to more than double at 343,000. ESRI has projected a 39% increase in demand for residential long-term care, alongside a 70% increase for homecare services.

In this sector, supply remains constrained with very few nursing homes under development. In 2020 Northwood Nursing Home in Santry, Dublin 9, Beaumont Lodge in Dublin 5, SignaCare Waterford at Christendom, Co. Waterford, and Willow Brooke Care Centre in Castleisland, Co. Kerry opened. Appetite for this sector looks likely to continue in the coming year, particularly for primary care centres, nursing homes and other residential care facilities and private hospitals. Investment in nursing homes is dominated by French, German and Dutch groups; Irish and UK funds are the main investors in the primary care centre sector – and this is likely to continue in both respects.

ESG

Ireland boasts an ESG Relevance Score (RS) of 5 for both Political Stability and Rights, and for the Rule of Law, Institutional and Regulatory Quality and Control of Corruption, as well as a high World Bank Governance Indicators (WBGI) of 89.2. These scores reflect a long track record in the country of stable and peaceful political transitions, well-established rights for participation in the political process, strong institutional capacity, effective rule of law and low-level corruption.

The Economist Intelligence Unit’s Democracy Index 2020 saw Ireland ranked at number eight, scoring highly in particular on Electoral process and pluralism, Political participation, Political Culture and Civil Liberties.

The country is also considered progressive in the way it is transitioning towards an equitable, fair and sustainable society. The Transitions Performance Index (TPI) ranks Ireland as the third-best country in the EU and fifth-best in the world in creating conditions for a sustainable future. Ireland was also shown to have the most improved overall score of any of the 70 countries assessed in the study, which included all 27 EU member states. Switzerland topped the list, followed by Denmark, the Netherlands and the UK.