As the year draws to a close, the challenges of these unprecedented times persist. However, there were moments of pride as Bartra was able to navigate uncertainty and build and create a unique business model to help our clients and their families pursue their dream and live better.

There were many moments in 2021 to celebrate. Here are some of the highlights from a truly memorable year.

-02-1-1024x683.jpg)

-02-1-1024x683.jpg)

In April, Colmcille House at Stoneybatter, Social Housing Phase I was completed. The project offers 23 apartments to house families in need and has signed a 25-years Enhance Lease with the government, providing excellent income stability. Poplar Row, another Phase I Social Housing project also located in Dublin, will be completed next year, offering 39 apartments.

The specification and construction quality of our social housing developments never disappoint; this is our commitment. Take a look at our completed Colmcille House project below.

In May, we opened a new office in Ho Chi Minh City to provide streamlined, in-group, end-to-end Irish immigration services for our clients in Vietnam, as handled by our dedicated local team. Since then, nearly €7 million has been raised from Vietnam investors.

As we were in Hong Kong, we became the first company in Vietnam to provide direct Irish investment immigration services, and we are thrilled to have achieved amazing results, despite having only opened the office in May and considering the challenges of the pandemic.This shows that our clients have absolute confidence in our business and projects.

▲ Jenny Thao Dang, Head of Bartra Wealth Advisors Vietnam, was interviewed by Ho Chi Minh City television channel HTV9 in November

In July, Bartra’s Phase IV Clondalkin nursing home project was fully subscribed, raising €20 million from IIP applicants for this 146-bed project. The construction of Clondalkin began in June, following three earlier nursing home projects that are already in operation. Bartra is the only group that integrates development, operation and management in IIP projects, which are run and managed by a dedicated division – Bartra Healthcare. Bartra’s nursing homes are safe, authorised and much-needed projects in Ireland, and they have a state-backed revenue stream.

We are committed to the quality of our nursing homes and to providing our clients with their principal repayment and 4% interest per annum. The Clondalkin scheme is popular among our clients, who have said they can use the 20% interest obtained at maturity, which is €200,000, to pay for their children’s school fees or to buy property in Ireland.

In August, Bartra published Ireland: An Essential Guide. Co-written with an Irish journalist, the 74-page book provides information on everything from planning a trip to Ireland to making a move and includes a wealth of practical tips such as suggested places to shop, drink and eat, where to find information on public transport, and how to seek medical advice, understand banking requirements, locate desirable living districts, evaluate property types for purchase, select schools and many more helpful do’s and don’ts.

Ireland: An Essential Guide is available in three languages – English, Chinese (Simplified and Traditional) and Vietnamese. Click here to get a free printed copy.

In August, Bartra’s Shanghai team moved into a new office in Wheelock Square, one of the newest and tallest buildings in Puxi, Shanghai. To date, we have opened offices in Shanghai, Beijing and Shenzhen in China. This is also the first year we have offered clients direct Irish investment immigration services in China, encouraged by the success of our business model in Hong Kong and Vietnam.

At the opening ceremony of our new Shanghai office, James Hartshorn, CEO and Co-founder of Bartra Wealth Advisors, said: “Over the last five years, Bartra has provided investors with the best IIP projects in the market with minimal risks. We also established a local landing team in Ireland to complete our one-stop-shop services. We will not forget why we started in the first place. Going forward, we will continue to provide first-class IIP projects and services, and work hard to offer more opportunities for our clients to have a better life.”

-03-1-1024x683.jpg)

-03-1-1024x683.jpg)

In October, we launched the Phase V Cookstown Tallaght Nursing Home globally. This purpose-built project will provide 131 beds. Offering just 20 slots for IIP investors, more than half have already been sold with Bartra raising €6 million in two weeks at the project ‘pre-launch’ stage from IIP clients in Hong Kong and Vietnam.

Cookstown Tallaght is located in the heart of Tallaght, a thriving urban hub with a population of 80,000 making it one of Dublin’s largest suburbs. It benefits from excellent transport links – the Belgard Luas light rail station is just 250 metres away, providing access for both staff and the families of residents. It also boasts proximity to major hospitals, including Tallaght University Hospital, Ireland’s leading academic teaching hospital, which is less than a kilometre away, and St James’s Hospital, just 8km away.

In September, we received planning permission for the €400 million redevelopment of O’Devaney Gardens (a non-IIP project) in Dublin 7. This project will be our largest in-house project to date, delivering more than 1,000 units. This development will also encompass two new parks, dedicated cultural and community spaces, shops, a café and a crèche.

Aside from IIP projects, Bartra Group’s property portfolios span all sectors of the market in Ireland, including commercial real estate, residential homes, shared living and renewable energy. It is worth mentioning that, at the end of 2019, the Irish Government’s Ireland Strategic Investment Fund (ISIF) invested €8 million in Bartra’s co-living business. The confidence of the government and investment from the sovereign development fund in our projects demonstrates the solidity of our businesses.

In September, Bartra received more than 40 renewal permissions, maintaining its 100% renewal rate.

We pride ourselves on delivering streamlined end-to-end services. Our unique business model supports clients throughout their investment and immigration journey, from immigration advisory and case submission to visa renewal and exit execution through to landing services.

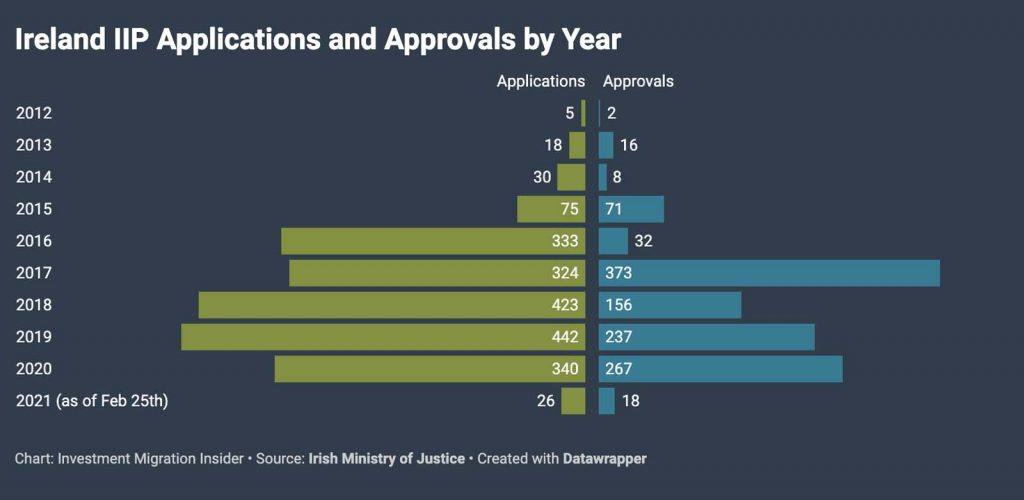

By the end of November, we had received nearly 60 IIP applications, with an approximate investment amount of €50 million.

Across Asia, we have a monopoly on the IIP with the largest market share in Enterprise Investment. This is our expertise. Investing in the IIP with Bartra is very safe, and we maintain a 100% application approval rate and renewal rate, providing 100% capital protection.

In Q4 of this year, investors of our first nursing home project, Loughshinny, began receiving their repayments. Loughshinny was built in May 2019, and is currently in operation, offering 123 beds and the highest HIQA standards. We are pleased to see our clients are happy, with many choosing to re-invest in additional Bartra businesses.

▲ Loughshinny, Bartra’s first nursing project, built in May 2019

We are grateful for everything we have achieved in 2021 and look forward to another successful year full of opportunities in 2022. We would like to take this opportunity to thank our clients and friends, peers and partners, for all of your dedication, support and hard work.