Similar to many other foreign investments, investing in the IIP at the right time can be beneficial from a foreign exchange perspective. Knowing how to take advantage of the forex (FX) market means you can budget for an investment more effectively and potentially save a considerable amount of money. However, the exchange rate can fluctuate dramatically in a short period of time, and investors need to act quickly to avoid missing out on a foreign exchange opportunity.

What is happening now?

The Russia-Ukraine war has hit many currencies hard. J.P. Morgan Research expects the US dollar, the Swiss franc and the Japanese yen to outperform high-beta currencies. The Russia-Ukraine conflict will likely see the euro weaken versus other reserve FX given the Eurozone’s reliance on Russia for energy.

Since the war in Ukraine began, the euro has lost value against the US dollar, British pound and other major currencies as investors believe the conflict will substantially slow the region’s economic growth rates. Goldman Sachs co-heads of global FX, rates and EM strategy, Zach Pandl and Kamakshya Trivedi, said the Wall Street giant’s constructive outlook on the euro was off the table as long as the military conflict continues.

So for how long will the euro fall? Standard Chartered Bank expects the uncertainty in Ukraine to plague short-term sentiment of the euro. Technically, the closest support level for EUR/USD is 1.10, followed by 1.08 and 1.0635; if the situation in Ukraine shows signs of stabilisation, this may trigger a rebound in EUR/USD towards 1.1400.

What does this mean to IIP investors?

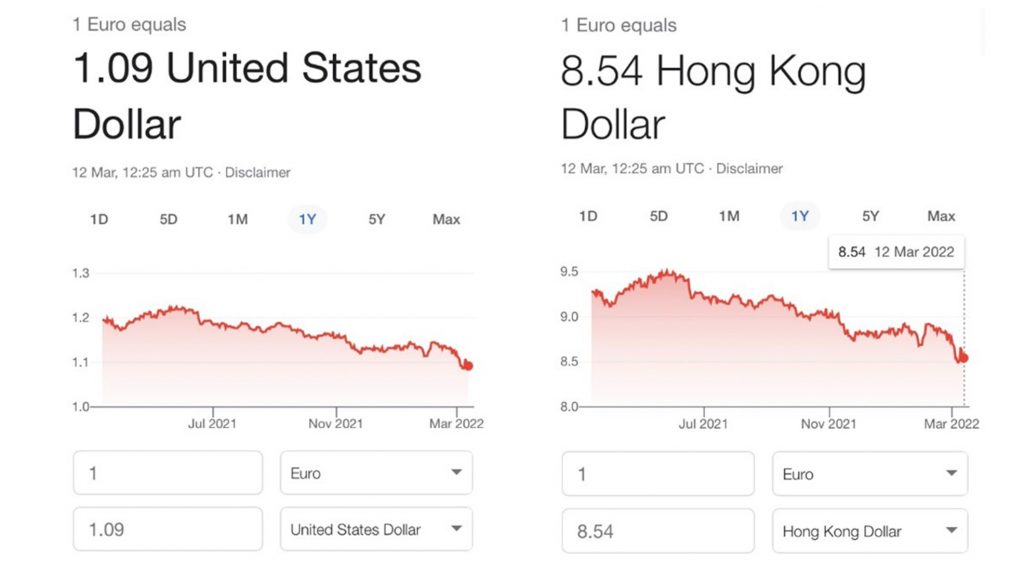

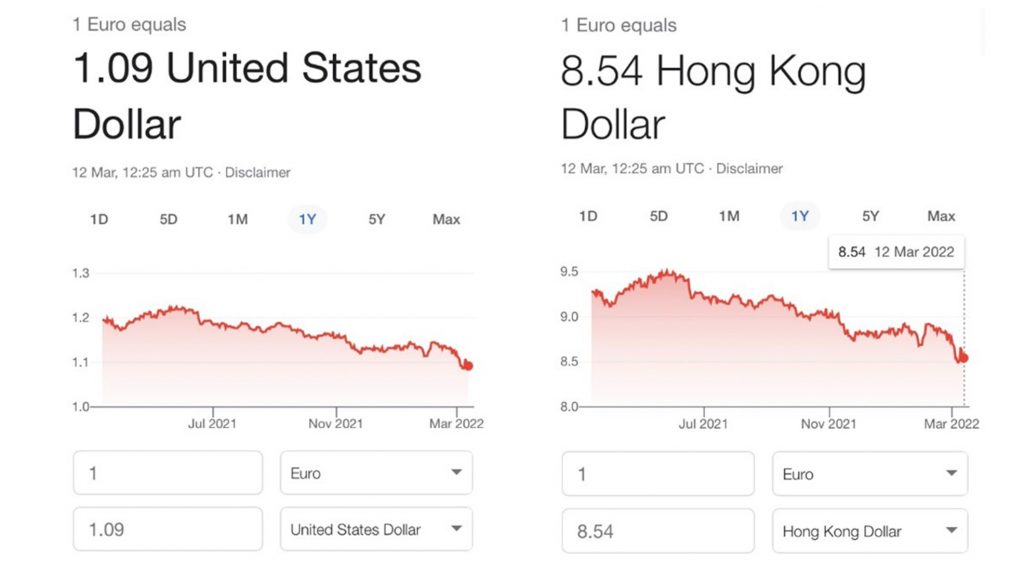

The war in Ukraine has led to significant changes in the world’s major currencies, which impacts their purchasing power. For example if you earn in Hong Kong dollars, where HKD is the quote currency, the euro has dropped in value (EUR/HKD) from 9.5062 a year ago at its height to its current low of 8.4953 as of March this year. For USD, EUR/USD fell to a low of 1.0866 on March 7 from a high of 1.2339 in January last year.

The exchange rate of EUR/USD and EUR/HKD on March 12.

IIP investors are required to invest 1 million euros into IIP qualified projects when they receive their pre-approval letter after application. If investors can seize a currency opportunity by taking advantage of a strong USD or HKD, and a weak EUR, they can potentially enjoy significant savings. For example, when investing at 8.5 EUR/HKD, the 1 million euro investment sum only requires capital of HKD 8.5 million as opposed to HKD 9.5 million a year ago. Investors may find their capital can be used more effectively by saving around one million Hong Kong dollars.

As the Russia-Ukraine conflict intensifies and continues, and focus switches to the looming threat to European energy supplies, Pandl and Trivedi suggest that the currency will likely trade even lower—around 1.07-1.08, given the moves in other market variables.

Our advice to IIP investors considering Irish immigration is to seize this opportunity and apply and invest now.

What are the other factors to consider?

Exchange rates are very difficult, if not impossible, to predict, at least in the short to medium term. Investors may argue that the euro could still be underperforming against the USD or HKD in 3 or 5 years time when they can regain their capital at maturity.

The 4% net annual interest return from investing in Bartra’s nursing home project can be treated as the risk-adjusted return on capital for any currency depreciation or to price in inflation. It will still provide a significant income to investors over the 5-year investment term aside from the 100% capital return.

Additionally, it is always advisable that investors purchase investments in various currencies to gain international exposure and diversification, and reduce overall risk.

Summary

According to FxStreet, the bearish trend of the euro is expected to continue through Q1 and the Q2 of 2022, and is likely to face selling pressure in the short term. However, the euro has contributed to the stability, competitiveness and prosperity of European economies for more than two decades, and is the second-largest reserve currency as well as the second-most traded currency in the world after the US dollar. It should regain its value once there is more clarity around the current conflict and the European market regains its stability.

Disclaimer:

This should not be taken as advice on Foreign Exchange Trading. Investors must understand that FX involves risks. When converting foreign currencies into other currencies (including Hong Kong dollars), the fluctuations of foreign exchange may see customers make profits or incur serious losses.