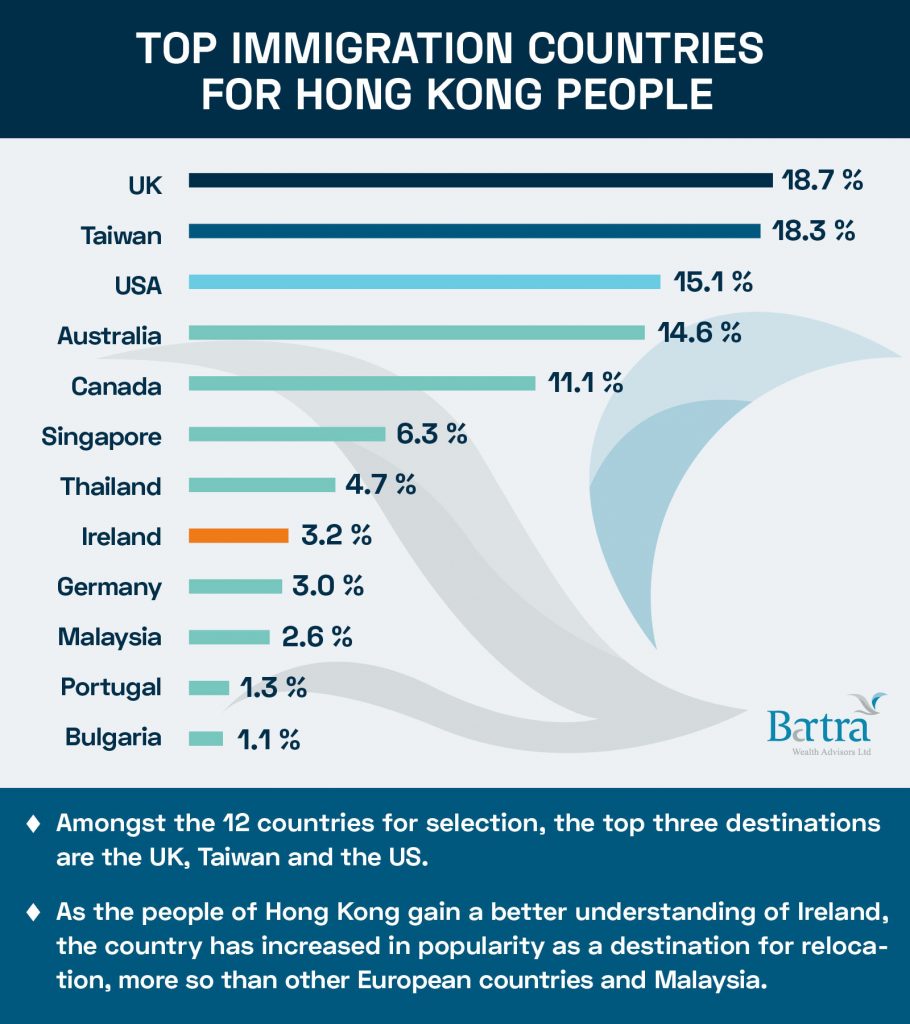

Whenever a family chooses to emigrate to another country, there are a number of factors to consider, such as quality of education and job market prospects, as these may affect your children’s future. It would defeat the purpose of studying abroad if your children were not able to find a good job after graduation and subsequently remigrate. In recent years, Ireland has become one of the top immigration destinations, partly due to its unrivaled advantages in education and thriving job market.

Before looking into Ireland’s job market, let’s talk about how outstanding Irish education is. Ireland has one of the best education systems in the world, ranking seventh globally. As mentioned in our blog “Irish education – a future for your children”, Ireland remains the only English-speaking country in the EU following Brexit. An Irish education is strongly influenced by Britain, and the education systems of Hong Kong, Ireland, and the UK have many similarities. The primary goal of Irish education is to provide cultural, artistic, sporting, psychological and spiritual development as well as to prepare children for academia.

Under the Common Travel Area (CTA) arrangement between Ireland and the United Kingdom, Irish citizens are entitled to live, work and study in the UK. Through the Ireland Immigrant Investor Programme (IIP), your children can obtain residency status in Ireland and will be eligible for an Irish passport when they are aged 18 or over and have been residents in the state for at least five years. Once your children become Irish citizens, they can choose to study at top universities in the UK or Ireland. If they opt for a British university, they can qualify as local students and pay the ‘home rate’ instead of overseas rates, saving nearly three times the tuition fees.

Job Market

With the rapid growth of the Irish economy in recent years, local companies have continued to expand and are hiring more graduates. Of all EU member states, Ireland was the only one that maintained economic growth amid the global pandemic in 2020. GDP expanded by 3.4% according to the Central Statistics Office Ireland, despite falling 6.3% in the EU overall (and by 6.8% in the eurozone).

Boasting a competitive corporate tax rate of 12.5%, Ireland offers an attractive taxation framework and has been one of the most attractive countries for Foreign Direct Investment (FDI), while maintaining the highest economic growth rate in Europe for six consecutive years.

Ireland is home to:

- Global tech giants, including Apple, Microsoft, and Google

- 9 of the world’s top 10 pharmaceutical companies, including Pfizer and Johnson & Johnson

- 18 of the world’s top 25 MedTech companies

- Half of the world’s top 50 banks

- More than 250 global financial institutions

What is the job market in Ireland like? Take a look at the following data:

- Many new job openings

The number of job postings increased by 34% in 2021 Q1 compared to the previous quarter, according to the latest Irish Jobs Index by ie. This shows that Irish companies have quickly recovered from the pandemic and are actively expanding. - The new financial hub of Europe

According to New Financial, more than 400 financial firms have moved from the UK as a result of Brexit, of which 135 chose to relocate to Ireland (the most in Europe). New Financial expects relocation numbers to increase over time, with Ireland continuing to be the biggest beneficiary. - Europe’s Silicon Valley

As stated by the Department of Enterprise, Trade and Employment of Ireland, there are currently more than 80,000 tech professionals in Ireland, with a further 8,000 IT job openings forecast each year in Ireland. - Talent from all over the world

According to Eurostat, 1 in 8 people living in Ireland come from abroad, which is among the highest in Europe.

Top Sectors in Ireland

It is easier for your children to find a job after graduation if they specialize in one of the country’s booming sectors. So, what are the key sectors that have prospered in Ireland? Here are the 7 best-paying industries in Ireland, according to CPL’s latest Salary Guide for 2021:

| Industry | Top Salary in 2020 | |

| 1 | Accountancy & Tax | €150K – €275K |

| 2 | Finance Services | €190K – €260K |

| 3 | Legal | €120K – €200K+ |

| 4 | Marketing | €95K to €160K |

| 5 | Life Sciences | €155K – €280K |

| 6 | Technology | €120K – €280K |

| 7 | Technology, Infrastructure | €120K – €140K |

After considering some of the most popular industries, below we detail four noteworthy sectors in Ireland based on data and trends:

Financial Sector

Ireland, the only English-speaking country in the EU, remains the top destination for financial firms to relocate to after Brexit, which brings Ireland’s prosperous financial industry to the next level. The funds and asset management sector have long been in high demand, while risk and compliance professionals are also attractive as Ireland’s fintech space continues to boom.

Due to the growing complexity of financial markets and transnational transactions, demand for taxation professionals such as tax accountants and tax analysts is also rising.

The financial district of Dublin, Ireland

Life Sciences & Pharmaceuticals Sector

The global demand for medical and healthcare products is increasing day by day. Did you know that Ireland is one of the world’s largest exporters of pharmaceutical products? More than 85 pharmaceutical companies operate over 100 facilities in Ireland, and 9 of the world’s top 10 pharmaceutical companies are established in Ireland. In 2020, Ireland’s total exports of pharmaceutical products hit a record high, reaching US$65.73 billion.

Ireland’s significant pharmaceutical sector plays a decisive role in creating employment. Jobs related to life sciences and pharmaceuticals have been featured on Irish job search platforms for many years, and the Covid-19 pandemic has provided the development of the industry with a boost. According to CPL, professionals in areas such as MSAT, quality, and chemistry R&D are in high demand.

Life sciences and pharmaceuticals are one of the most popular sectors in Ireland

Technology Sector

Technology has always been one of Ireland’s key sectors. Ireland is home to a huge array of tech giants, such as Apple, which has been based in Cork since 1980. In Dublin’s Silicon Docks, you will find the European Headquarters of other tech giants such as Google and Twitter, and e-commerce stars like Amazon and PayPal. Many Chinese tech companies have also entered Ireland in recent years. For example, Tik Tok, a viral social video-sharing app, announced in 2020 that its European headquarters will be located in Dublin.

Fun Facts

- Brendan Greene, the creator of the world-renowned multiplayer shooting game PUBG, is Irish.

- Many companies in Ireland like to hire foreign nationals. For example, LinkedIn’s 1,600 employees in Ireland speak 35 languages; Google’s 70,000 employees in Ireland speak 49 languages. Many people, even if they are not EU citizens, come to Ireland to look for job opportunities.

- In May 2021, Google and Dublin City Council launched “Air View Dublin”, an initiative that measures air quality across the city.

Construction and Engineering Sector

According to Construction magazine’s annual Top 50 CIF Contractors listing for 2019, the top 50 Irish contractors reported total turnover of €8.39 billion in 2018, an increase of more than €1.5 billion over 2017. Amid Covid-19 and lockdowns, the construction industry has been hit hard and has met with many challenges. However, with the introduction of vaccines and the potential stabilization of the pandemic, the construction industry in Ireland is gradually getting back on track.

According to CPL’s report, the most buoyant areas in construction include social housing, hospital builds and infrastructure, in addition to residential and commercial buildings.

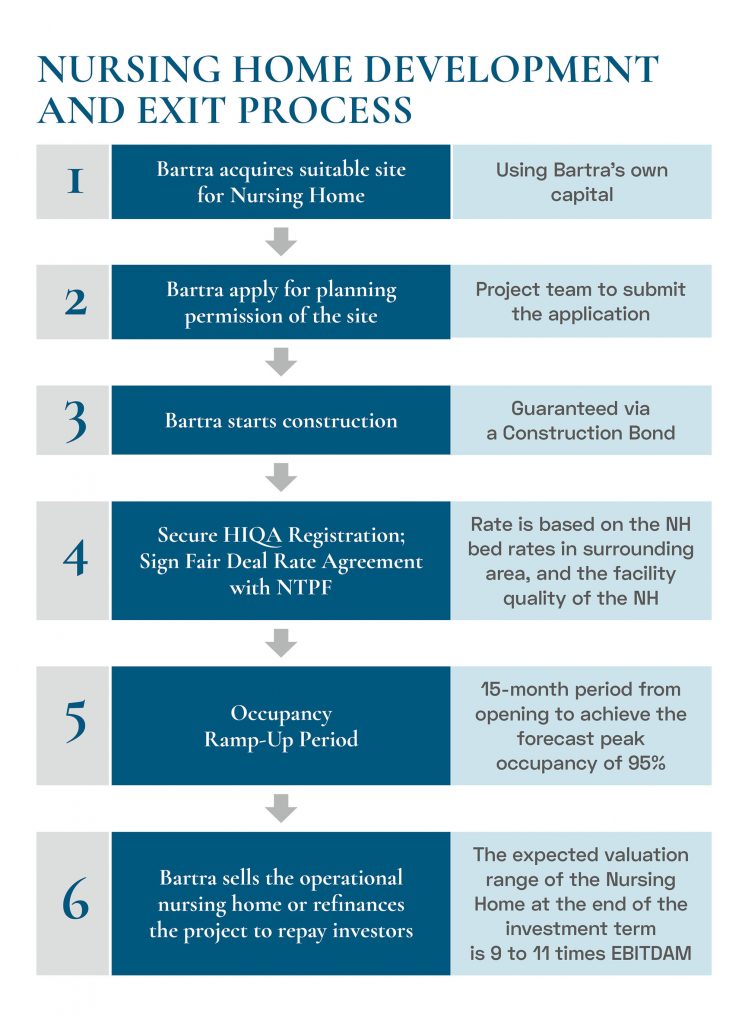

As one of the leading real estate developers in Ireland, Bartra has lodged a planning application for a major new community development with 1,047 A-rated social, affordable and private homes in the former O’Devaney Gardens site in Dublin 7, which has been the subject of discussion for more than 25 years. There will be two new parks, dedicated cultural and community spaces, shops, cafés and a crèche, comprising a sustainable, enterprising community that meets the needs of future residents.

Summary

Ireland’s economic success is no fluke, but the result of years of hard work by the Irish government. Diversified industries have laid a solid foundation for the Irish economy, which has remained resilient during the pandemic. As such, whether for education or employment, Ireland holds the title of the best immigration destination in Europe.

-1005x1024.jpg)